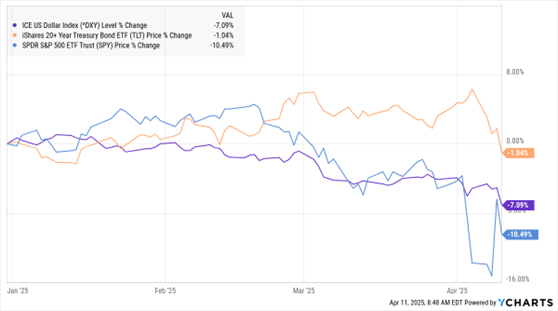

Stocks are falling again in the early going today, but the real action is in other markets. The dollar is dropping sharply, while gold is surging. Long-term US Treasuries are also sliding. Crude oil is flat.

There’s a sale going on...a sale of US assets. That is torching the dollar, while sending gold higher and higher. The ICE Dollar Index tracks the greenback’s performance against six major world currencies – and it’s down more than 7% year-to-date. The euro alone just saw its biggest two-day rally against the greenback in 16 years.

Meanwhile, a broader, trade-weighted index produced by the Federal Reserve soared after President Trump was elected. But it has now given back all those gains and then some. At the same time, gold has soared. The yellow metal rose another $60 an ounce overnight and this morning, pushing it to a record high of $3,255.

DXY, TLT, SPY (YTD % Change)

Data by YCharts

Then there is the US Treasury market. Unlike in past episodes of stock market turmoil, Treasuries haven’t seen significant safe-haven inflows. Instead, bonds have fallen in price and yields have climbed. The yield on the 30-year Treasury Bond just saw its biggest four-day rise since Covid in 2020. Price volatility has also surged.

The US stock market isn’t looking so good relative to international markets, either. The S&P 500 is lagging an MSCI index that tracks global stocks by the widest margin since 2009. It all adds up to a global rebalancing – a significant shift of investor money away from US markets and US-dollar-denominated assets and into other markets around the world. It’s a clear short-term side effect of the Trump Administration’s policies...though the longer-term implications remain unclear.

In other news, China hiked its tariff rate on US imports to 125% - while also saying it wouldn’t raise it any higher for now. Beijing did threaten to retaliate in other ways if the US were to take further steps against it.

Finally, the biggest US banks kicked off the Q1 earnings season today. Wells Fargo & Co. (WFC) reported better-than-expected adjusted earnings of $1.33 per share. JPMorgan Chase & Co. (JPM) also beat estimates with $5.07 in EPS. Both firms warned of the potential fallout from the trade and tariff tussle, though. WFC shares are down 10.1% YTD, while JPM stock is off 5.2%.