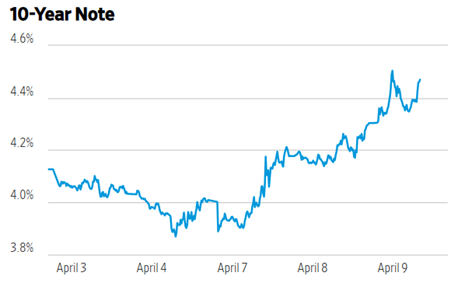

Stocks have been in full liquidation mode for a week. The same goes for oil. Now, BONDS are getting dumped, too. That helped drive the yield on the 10-year Treasury to 4.51% overnight – up 60 basis points from 3.9% as recently as Monday morning. The three-day rise in yields is the biggest since the Covid-19 pandemic in 2020.

Gold is on fire, though. The yellow metal recently surged around $93 an ounce to $3,083. That occurred as the US dollar sank again. The Dollar Index is now down 5.7% year-to-date.

With so much going on day-to-day…and even hour-to-hour...I know it’s hard to keep up. But the largest overnight development was that President Trump’s new, higher tariffs on China kicked in. Imports from the country now face a 104% levy. Trump’s tariffs on almost 100 other countries also began at midnight. Late yesterday, he pledged that pharmaceutical tariffs were coming soon, too.

Source: WSJ

Beijing waited a bit before retaliating. But this morning, policymakers there more than doubled the tariff on US imports to 84% from 34%. In addition to the bond market collapse, US crude oil futures responded by plunging around 6%. A key global price benchmark, Brent futures, dropped below $60 a barrel for the first time since 2021.

With the first-quarter earnings reporting season getting underway this week, investors are eagerly awaiting what Corporate America will say about the rapidly changing economic outlook. Delta Air Lines Inc. (DAL) didn’t spread much cheer this morning. The company yanked its 2025 revenue and earnings guidance, citing “broad economic uncertainty around global trade” and noting that “growth has largely stalled.”

Amid the volatility, it bears repeating: Here at MoneyShow, we have been educating investors and traders for more than four decades. We have seen all kinds of market environments, as have the hundreds and hundreds of experts we connect you with at our live conferences, during our virtual expos, and in the content we publish on our website, in our emails, and in video format across all major social media platforms.

You can rest assured we will continue to do ALL WE CAN to keep you informed and educated about what is happening. And we will continue to communicate expert strategies you can implement to protect and grow your wealth.