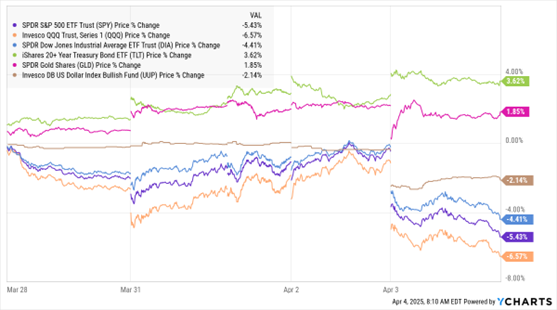

Yesterday was a tariff-fueled bloodbath in markets, with stocks plunging the most in any day since the Covid-19 pandemic in 2020. The damage ranged from roughly 4% in the Dow to 6% in the Nasdaq, with the total wealth wipeout coming to approximately $3 trillion. Crude oil got hammered, the dollar got crushed, and interest rates tanked. Even gold sold off in the early going, before rebounding later.

SPY, QQQ, DIA, TLT, GLD, UUP (5-Day % Change)

Data by YCharts

Wall Street thought President Trump would mostly use tariffs as negotiating tool…a bludgeon to beat better deals out of trading partners. That view went up in smoke this week. After Trump implemented widespread, aggressive tariffs that targeted foes and friends alike, global markets swooned.

Now, they’re taking another leg lower after China fired back overnight. Policymakers there said they would apply 34% tariffs on ALL US imports, starting April 10. Plus, China restricted exports of rare-earth metals to the US…banned imports of select US agricultural and meat products…and targeted several US companies and groups by adding them to export control and “unreliable entity” lists.

The latest move is only intensifying Wall Street worries about a global trade war, one that could push the US into recession. That was one reason oil was a particularly hard-hit commodity yesterday. Another catalyst: The OPEC+ nations tripled a planned supply boost set for May to around 411,000 barrels per day. The move accelerated a plan in process to unwind cuts of 2.2 million BPD that have been in place for some time.

What MoneyShow is Doing to Help YOU

All of that said, I hope you saw the special update we put out yesterday. If not, you can find it HERE. The short version? MoneyShow has been in the financial education business for 44 years. We have lived and traded through all kinds of markets – and any number of news-driven corrections, crashes, and epic rallies. And we stand ready to help you protect and grow your wealth – regardless of what markets do next!

First, dozens of our top experts are currently sharing their best insights and recommendations with attendees at our MoneyShow Masters Symposium Dallas – and if you’re there, you’re getting the “best of the best” help we can provide.

Second, if you’re not, do NOT miss our MoneyShow Masters Symposium Miami. It’s set for May 15-17. It will feature up-to-date, expert help from the nation’s leading financial minds. More details can be found HERE.

Third, my team and I are cranking out special expert interviews and articles in this monumental week. They’re entirely free. And they are packed with information designed to help you navigate this volatile environment.

For instance, you can view the just-released, tariff-focused MoneyShow MoneyMasters Podcast with Kathryn Vera of StoneX and Stephanie Link of Hightower Advisors.

I also just interviewed Kenny Polcari, chief market strategist for SlateStone Wealth, about his market thoughts. You can listen to that audio recording here (He was at a conference so apologies for the reception quality in the first part of the conversation).

PLUS, I sat down for a conversation with Brien Lundin, executive editor of Gold Newsletter. Gold has been performing exceptionally well – and I think you’ll enjoy his take on what’s driving that. He also covers what the tariff turmoil will mean for precious metals moving forward. Watch it HERE.

Finally, remember this simple market truth: Nobody ever made a dime panicking. Level-headed, data-driven decision-making is the key to building long-term wealth – and we will do all we can to help guide your decisions in the days and weeks ahead.