Investors are on pins and needles ahead of today’s big policy news. It won’t hit the tape until later in the day. But for now, equities are slumping, while gold, silver, and Treasuries are rising modestly.

Fasten your seatbelts…because Tariff Day (or if you prefer, “Liberation Day”) is here! President Trump will announce his long-awaited plans to attempt to rebalance global trade via wide-ranging tariffs. Media reports about what to expect were all over the map yesterday. But a White House Rose Garden event featuring the president, members of his cabinet, and others is scheduled for 4 pm Eastern today.

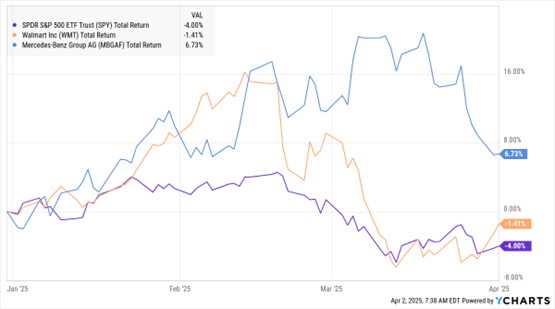

US companies that import goods from countries like China are trying to pressure suppliers to essentially eat the tariffs by lowering prices. Walmart Inc. (WMT) has been among the most aggressive, and its tactics have attracted unwanted scrutiny from Chinese officials.

SPY, WMT, MBGAF (YTD % Change)

Data by YCharts

But most economists see no way for US consumers to avoid price hikes on products large and small. It’s just a question of degree. Some products may no longer be available in the US at all. Mercedes-Benz Group AG (MBGAF), for one, may stop selling its cheapest SUVs in the US because they will no longer be economical to produce.

Wall Street has increasingly been finding new ways to give average investors direct or indirect access to “private” investments. That includes funds and investments in real estate, private equity, private credit, and infrastructure that were previously available to institutions and high-net-worth individuals only. Now, BlackRock Inc. (BLK) CEO Larry Fink has gone a step further.

He suggested in his firm’s annual letter that the “60/40” portfolio be put to rest. Replacing it? A “50% stocks, 30% bonds, 20% private assets” mix. Fink said that will offer investors greater diversification and better protection from volatility.