Stocks popped after Wednesday’s Federal Reserve meeting, but they’re giving up some ground to close out the week. Most other markets are flat-lining, including gold, crude oil, the dollar, and Treasuries. Bitcoin is hovering around $84,000.

The S&P 500 just dropped 10% -- crossing the “correction” threshold and spooking many investors. But the bounce back since then is causing money to pour back into the markets. Bank of America noted that $43.4 BILLION flowed into global stock funds in the week-long period ended Wednesday. That was the most in any week in 2025.

Retail investors alone plowed $12 billion into US stocks in the same period, according to figures from JPMorgan Chase & Co. That far outpaced the average over the last year, suggesting the “Buy the dip” mentality isn’t dead yet. It comes even as investor sentiment remains strongly bearish overall (ironically, something that could lead to more gains for reasons I spelled out HERE).

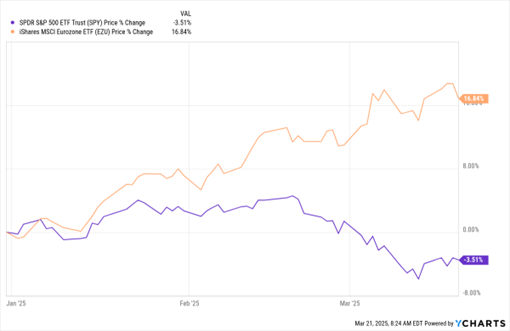

EZU, SPY (YTD % Change)

Data by YCharts

Meanwhile, European growth could get a notable boost from a massive borrow-and-spend plan just enacted in Germany. Politicians in Europe’s largest economy voted for a $1.08 trillion program of civilian and defense spending, a huge turnaround for one of the most parsimonious nations on earth. Worth noting: European stocks have been trouncing US equities in 2025. The iShares MSCI Eurozone ETF (EZU) has rallied more than 16% year-to-date, while the SPDR S&P 500 ETF (SPY) has dropped 3.5%.

Lastly, while we’re in a quiet time of year for corporate earnings, Dow component Nike Inc. (NKE) posted numbers late yesterday. Even though Nike beat estimates on both the top ($11.27 billion) and bottom line (54 cents per share), the stock slumped amid worries about the impact of tariffs on future profit. CFO Matthew Friend said tariffs on China and Mexico would slash Q4 gross margins by 400-500 basis points.