Stocks added to Friday's gains yesterday, but they're taking a breather this morning. Gold is rallying again along with silver and crude oil, while Treasuries and the dollar are flattish.

President Donald Trump and Russian President Vladimir Putin are holding a phone call today to discuss the Ukraine war and try to hammer out a cease-fire deal. No word on whether we’ll see a breakthrough. But we have seen the euro currency surge against the dollar and European defense stocks take off in recent weeks due to Trump’s actions.

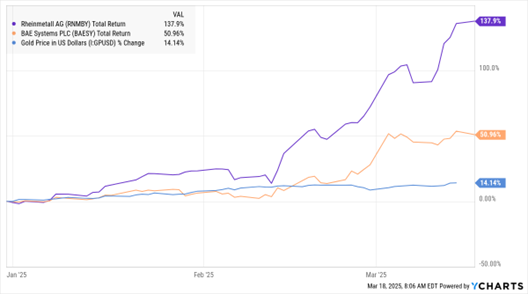

Why? They’ve spurred the European Union to focus on bolstering continental growth and defense spending. Many think they’ll steer buying toward domestic contractors when possible. Result: US-traded shares of German defense contractor Rheinmetall AG (RNMBY) have surged 137% year-to-date, while US tracking shares of British defense giant BAE Systems PLC (BAESY) are up 50%.

RNMBY, BAESY, Gold (YTD % Change)

Data by YCharts

Meanwhile, gold is continuing to rise amid worries about stability in Europe. Israel’s overnight bombardment of the Gaza Strip – a move that comes after several weeks of quiet during a tentative ceasefire – is adding to geopolitical worries. The metal topped $3,000 an ounce for the first time ever last week, and it’s now up more than 14% in 2025.

Lastly, search giant Alphabet Inc. (GOOGL) is buying the cybersecurity startup Wiz for $32 billion. That is up by a third from its initial takeover proposal last year and the most the Google parent has spent on any acquisition. Alphabet wants to boost its security and cloud computing infrastructure business, so it’s buying Wiz before the company can hit the markets via an Initial Public Offering (IPO).