Happy St. Patrick’s Day! Stocks are mixed in the early going, though investors are hoping we’ll see some green later after a strong rally Friday. Gold, silver, Treasuries, and the dollar are mostly flat, while oil is up a bit.

Investors are dealing with two issues today. First, Treasury Secretary Scott Bessent characterized the recent slump as a “healthy” correction over the weekend, adding that he is “not worried about the markets.” That suggests there is no “Trump Put” under stocks. The S&P 500 is down just over 9% from its February high, but many high-momentum, widely held stocks and cryptocurrencies are down much more.

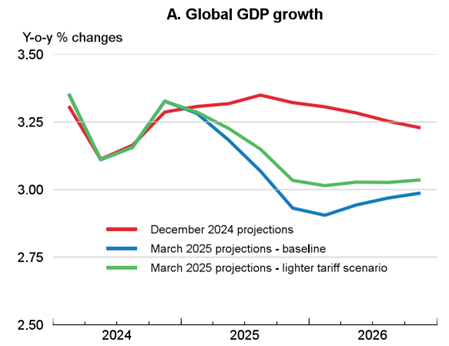

Source: OECD

Second, retail sales in February rose just 0.2% when economists were expecting a 0.7% rise. The ex-autos number was also weak (+0.3% vs. a +0.5% forecast). That could amplify concerns about the economy. The Organization for Economic Cooperation and Development (OECD) just cut its 2026 global growth forecast, while simultaneously raising its estimate for inflation.

Finally, markets will be closely watching to see what the Federal Reserve does and says this Wednesday. While Chairman Jay Powell and his fellow policymakers aren’t expected to cut short-term interest rates at this week’s meeting, they could provide important guidance on their views about inflation and growth. Rate futures markets are currently pricing in three 25-basis point cuts in 2025, up from only one a few weeks back.