Investors have been worried sick about renewed inflation and a rise in interest rates. But today’s data allowed them to catch their breath. Stocks are rising, while Treasuries are stable, the dollar is retracing some of its recent gains, and gold and silver are mixed.

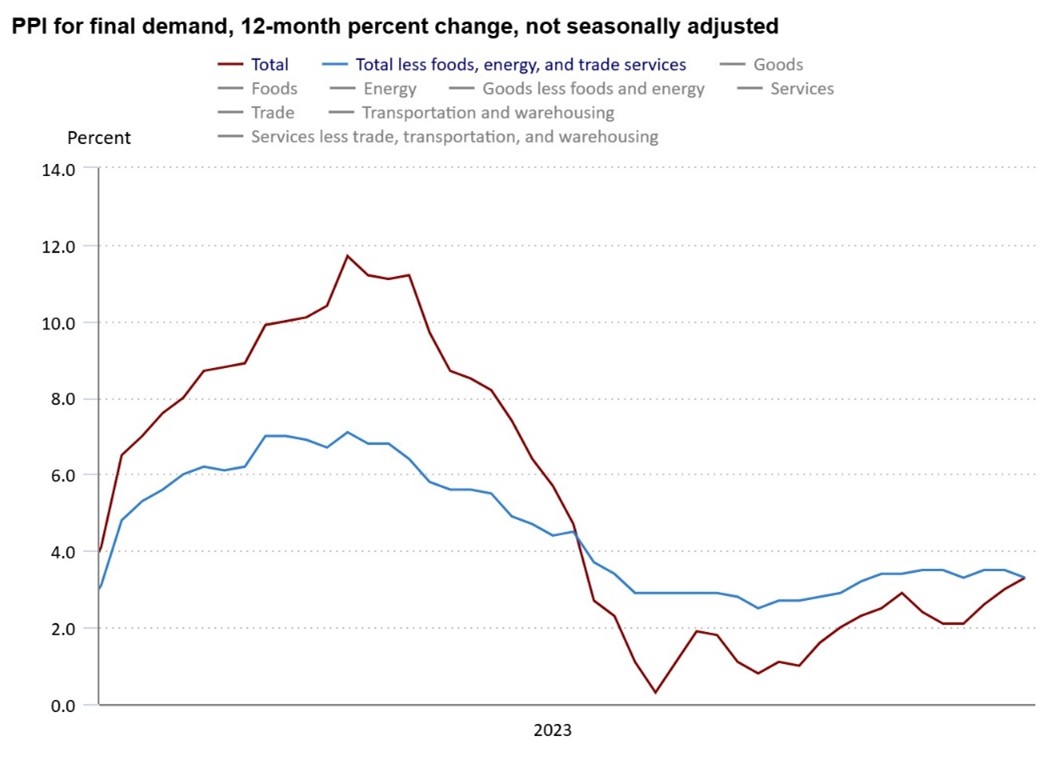

The Producer Price Index (PPI) isn’t as big a deal as the Consumer Price Index (CPI) when it comes to economic data. But it was enough of a positive outlier that it’s bolstering markets. Wholesale inflation rose 0.2% in December, lower than the 0.3% increase economists expected.

Source: BLS

More importantly, CORE PPI was unchanged last month. Markets expected a 0.3% rise. While year-over-year wholesale inflation has risen over the last two quarters, it’s well below the peak we saw in 2022.

It’s not Monday, but we do have a sizable merger to talk about. United Rentals Inc. (URI) agreed to buy H&E Equipment Services Inc. (HEES) for $4.8 billion to bulk up in the equipment rental space. The firms rent aerial work platforms, cranes, earthmoving machines, and other equipment to firms in the construction and industrial sectors. URI offered $92 per share in cash, more than double the $43.94 price HEES closed at yesterday.

Finally, cost estimates for the California wildfires keep climbing. Some analysts are expecting the price tag to top $30 billion for the insurance industry, up from a previous high prediction of $20 billion. More than 12,000 buildings have been burnt to the ground, and at least 24 people have died.

Wells Fargo & Co. (WFC) suggested in a report that home insurance providers like Allstate Corp. (ALL), Chubb Ltd. (CB), and Travelers Cos. (TRV) will be among the biggest payers. For some perspective on sector performance, the iShares US Insurance ETF (IAK) is up almost 20% in the last year, but down 4.5% in the last month.