Stocks slid into the close Friday, and they’re dipping again in the early going today. Gold and silver are down, too, while crude oil is higher along with the dollar.

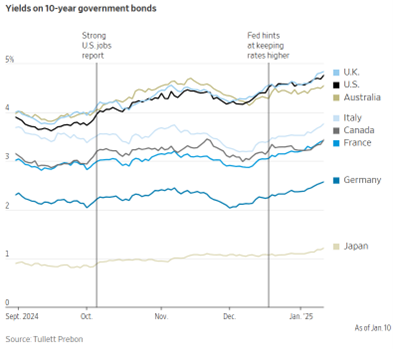

Interest rates, interest rates, interest rates. That’s all Wall Street is talking about and focusing on so far in 2025 – and stocks are suffering as a result. Yields are climbing in the US due to stronger economic data and dwindling expectations for Federal Reserve rate cuts this year. They’re also rising here and in some foreign countries due to concerns over growing government debt and deficit burdens.

Source: Wall Street Journal

Markets will get key inflation readings this week, including the Producer Price Index (PPI) on Tuesday and the Consumer Price Index (CPI) on Wednesday. Those could cause significant market volatility (one way, the other, or both!) depending on how hot or cold they turn out to be.

The next Fed meeting is set for Jan. 28-29 and rate futures markets are all but pricing out a Fed rate cut. A month ago, they were pricing in about an 18% chance of another 25-basis point reduction. The dollar is rallying in response to expectations US rates will remain higher than foreign rates for longer. That, in turn, is helping tighten financial conditions here.

Finally, crude oil just rose to a fresh five-month high around $78 a barrel. Driving the action are new US sanctions designed to close more loopholes that have allowed foreign buyers to secure Russian oil exports. The outgoing Biden Administration announced measures aimed at exporters, insurance companies, and actual oil tankers, something that could make it tougher for countries like India and China to continue importing Russian crude.