Stocks slid yesterday, though they closed off their session lows. Now, they’re rising modestly to round out this final holiday trading week. Gold, silver, and crude oil are flattish along with Treasuries, while the dollar is a bit lower.

Before going further, I want to remind you that our MoneyShow Top Picks 2025 Report is dropping THIS MONDAY, Jan. 6, at 8 am Eastern. We’ve been producing this annual report for decades, and it contains the best picks for the next 12 months from dozens of our top experts. To get the 78 picks from 44 different contributors, click HERE. And feel free to share the link with family, friends, and anyone else you think could use a portfolio power-up in 2025!

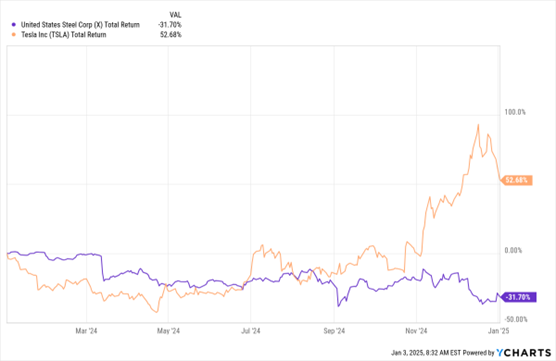

As for financial markets news, it’s official: The Biden Administration will block the proposed takeover of United States Steel Corp. (X) by Nippon Steel Corp. (NPSCY) of Japan. There had been stiff opposition to the foreign purchase of a long-time American industrial icon for months, leading X shares to trade well below Nippon’s $55 offer price. Incoming President Donald Trump said he would move to block the deal if Biden didn’t.

X, TSLA (1-Year % Change)

Data by YCharts

Tesla Inc. (TSLA) just announced the first-ever annual decline in sales. It delivered 1,789,226 vehicles around the world in 2024, compared with 1,808,581 in 2023. That missed Wall Street expectations for a slight increase, helping drive TSLA shares down 6% on the day. Still, the stock is up 59% in the past year on hopes its self-driving car, robotics, home-power, and battery-related initiatives will drive profit growth in the years ahead.

Lastly, at the top of the list called “Things you might not be monitoring, but probably should” is the move in the Chinese yuan. It just broke down through the 7.3-yuan-to-the-dollar level for the first time since Q4 2023.

Since the currency’s value is tightly managed by Chinese financial authorities, this is a sign they’re willing to devalue the yuan to gain an edge in the export market. Chinese bond yields recently fell to their lowest level ever amid concerns about the state of the domestic economy, despite a raft of aggressive stimulus programs announced in 2024.