The Dow Jones Industrial Average couldn’t get out of its funk yesterday, dropping for the ninth session in a row. That’s the longest losing streak since 1978. Equities are trying to bounce back in the early going today, as is crude oil. Gold and silver are mostly flat along with the dollar and Treasuries. Bitcoin is easing back under $105,000.

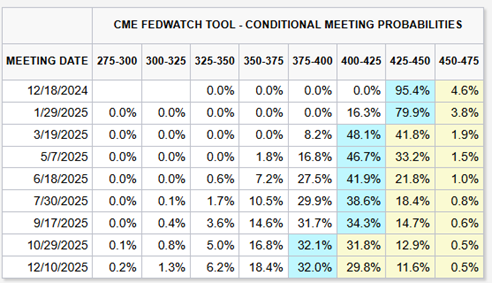

Today is the day. The day the Federal Reserve will cut interest rates for the final time in 2024. But what happens after this all-but-guaranteed 25-basis point cut? That’s where things get foggy. The federal funds rate will drop to a range of 4.25% to 4.5% with today’s move...and rate futures markets are currently pricing in additional reductions next year.

But as you can see in this graphic from CME FedWatch, traders don’t think the Fed will cut at every meeting in 2025. The highest-probability outcome right now (shown in light blue...and with the caveat this is BEFORE Fed Chairman Jay Powell hosts his afternoon press conference and provides some guidance) is for the Fed to “skip” a cut in January. Then it’s expected to cut in March before skipping even more meetings to see how things pan out.

Source: CME FedWatch

Again, this WILL change depending on what Powell says and what the inflation and growth data looks like in early 2025. But clearly, baked-in cuts at every meeting are a thing of the past.

One other thing to watch: An emerging markets kerfuffle in Brazil. The country’s real currency, government bonds, and stock market are all sliding. The catalyst? Worries about enormous debts and deficits, and skepticism over plans from President Luiz Inacio Lula da Silva to tame them. While US markets aren’t showing signs of contagion selling, the iShares MSCI Brazil ETF (EWZ) has slid more than 11% in the last 60 days. The iShares Latin America 40 ETF (ILF) is down almost 10%.