It’s been an “interesting” market to say the least. More on that below. Meanwhile, equities are taking on water in the early going along with gold, silver, and crude oil. Treasuries and the dollar are flattish, while Bitcoin recently topped $107,000.

Talk about a mixed market! The Dow Jones Industrial Average just dropped for the eighth day in a row. Meanwhile, the Nasdaq Composite rose another 1.2% to its 38th record of the year. As for the S&P 500? It climbed, but had its 11th consecutive day of negative breadth (more stocks in the index closing down than up).

How odd is this? The Dow hasn’t dropped eight days in a row since June 2018. There has NEVER been a Dow-Nasdaq divergence like this since the Nasdaq was created in 1971. And the S&P 500 hasn’t had this long of a losers-over-winners streak since Dow Jones Market Data started tracking in 1999.

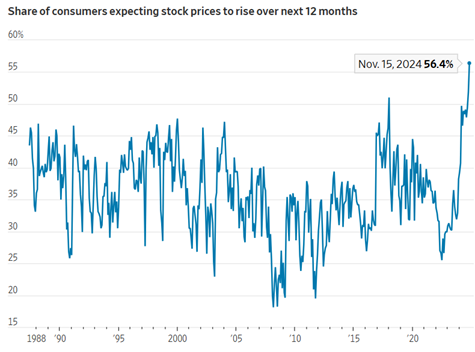

For those of us who have been (correctly) bullish and have talked about broadening markets for some time, this narrow action is more troublesome. It doesn’t help that sentiment has gotten more euphoric, with more than 56% of those polled by the Conference Board expecting stock prices to rise in the coming year. That’s a record high, as you can see here.

Source: Conference Board, via Wall Street Journal

Don’t tell Broadcom Inc. (AVGO) shareholders to worry, though. The stock just soared 38% in two trading days amid optimism it’ll be the “next Nvidia Corp. (NVDA)” The chipmaker forecast that demand linked to the Artificial Intelligence (AI) boom could boost revenue by as much as $90 billion in fiscal 2027. The stock has already more than doubled in 2024, making this AVGO’s best year since it went public in 2009.