Stocks look set for a modest pop to start this pre-Christmas trading week. Gold and silver are up a smidge, crude oil is down a bit, and the dollar is mostly flat. Bitcoin topped $106,000 before pulling back.

MicroStrategy Inc. (MSTR) has been a darling of the cryptocurrency crowd because it has bought Bitcoin hand over fist. The software company holds around $44 billion of Bitcoin on its balance sheet, approximately 2% of the cryptocurrency's global supply. Now, MSTR shares are being added to the Nasdaq 100 Index.

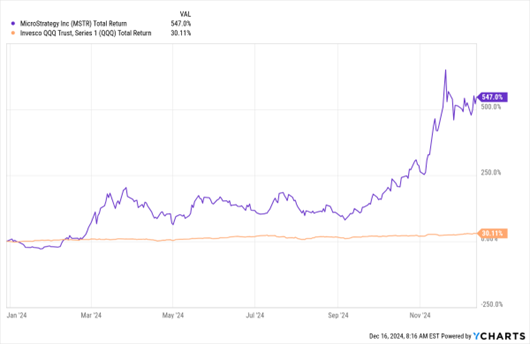

That could spur more buying of its shares from ETFs like the Invesco QQQ Trust (QQQ) and passive investors who track the index. MSTR shares rose in response to the news, adding to eye-popping year-to-date gains of 547%. The QQQ, for its, part, is up more than 30% in 2024.

MSTR, QQQ (YTD % Change)

Data by YCharts

The cocoa futures frenzy is back in the news, with prices surging to another record above $11,700 per ton amid ongoing supply concerns. West African farmers have been dealing with bad weather and poor harvests, and futures have more than doubled this year in response. Candy companies like Hershey Co. (HSY) have raised prices to compensate.

Speaking of HSY, the company reportedly rejected a takeover proposal from Mondelez International Inc. (MDLZ). MDLZ responded by announcing a $9 billion stock buyback and saying it would pursue acquisitions “focused on bolt-on assets.” In other words, it probably will NOT proceed with the $40 billion-plus HSY takeover.

Finally, the Federal Reserve is set to lower interest rates again at the policy meeting that concludes this Wednesday. But the 25-basis point move could be followed by a pause in the cutting cycle while Fed officials try to assess whether inflation is truly tamed. A Wall Street Journal article from “Fed Whisperer” Nick Timiraos today suggested some hawkish Fed members are wavering on the need for more rate reductions.