Markets appear to be taking the latest geopolitical shake up in stride, with stocks sanguine to start the week. Crude oil, gold, and silver are modestly higher, while Treasuries and the dollar are flattish. Bitcoin is hanging in just below $100,000.

The Syrian government collapsed under the assault of rebel troops over the weekend. President Bashar al-Assad reportedly fled the country and the Hayat Tahrir al-Sham opposition group took over. HTS is still designated a terrorist organization by the US due to its past ties to Al Qaeda, though its leaders claim to have reformed.

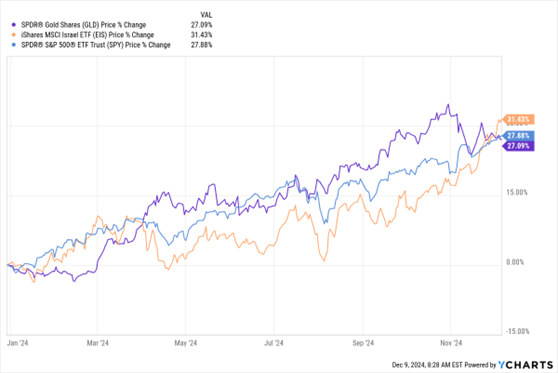

Markets typically influenced by turmoil in the Middle East, including crude oil and gold, largely shrugged at the news. That said, the SPDR Gold Shares ETF (GLD) has risen 27% this year for a variety of other reasons beyond geopolitical turmoil. In case you were wondering, the iShares MSCI Israel ETF (EIS) has also been on a tear, with year-to-date gains of more than 31%. The ETF is heavily tilted toward strong sectors like technology (with a 37% weighting) and financials (24%).

GLD, EIS, SPY (YTD % Change)

Data by YCharts

Wall Street strategists are tripping over themselves to issue bullish targets for 2025. Oppenheimer Asset Management is the latest to project double-digit gains for the S&P 500, publishing a 7,100 target for year-end 2025. It’s nice to see them coming around to the “Be Bold” bullish stance I’ve had since the start of 2023...but from a contrarian standpoint, it's mildly concerning.

Finally, Nvidia Corp. (NVDA) is in China’s crosshairs – just as Chinese companies have increasingly fallen under US scrutiny. The country is investigating whether the semiconductor powerhouse violated anti-monopoly laws in the wake of its $7 billion deal to buy Mellanox Technologies Ltd. in 2020. China approved the purchase on the condition that Nvidia treat Chinese customers fairly, but the State Administration for Market Regulation is determining if that has been the case.