Stocks are back on the move higher after a flat day yesterday. Gold and silver are flat, Treasuries are lower, and the dollar is up modestly.

Markets got hit by one of those “out of left field” developments yesterday when South Korean President Yoon Suk Yeol declared martial law. Yoon has faced stiff opposition in the country’s National Assembly since he got elected in 2022, and the move was a gambit to shift political conditions on the ground.

Given the close US-Korean ties, including the nation’s hosting of thousands of US troops, the move initially caused dislocations in currency and equity markets. It didn’t help that this was the first such declaration there since the 1980s.

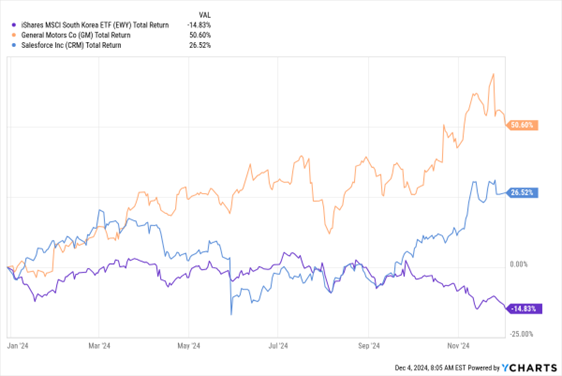

But after frantic pushback on multiple fronts, Yoon backed down and rescinded the declaration...and global markets have basically resumed normal trading. That said, the country hasn’t been a good play for US investors. The iShares MSCI South Korea ETF (EWY) is down 14% year-to-date and 24% in the past three years.

EWY, GM, CRM (YTD % Change)

Data by YCharts

Things aren’t going so well for General Motors Co. (GM) in China. The global automaker said it would slash the value of its Chinese joint ventures by as much as $2.9 billion, plus take restructuring charges of $2.7 billion, in the fourth quarter. GM owns 50% of its venture with SAIC General Motors Corp. It lost $347 million in the first nine months of 2024 amid stiff competition with fully domestic Chinese automakers.

Finally, software giant Salesforce (CRM) beat third-quarter sales targets and raised its full-year 2025 forecast. The company has integrated Artificial Intelligence (AI) tech into products like Agentforce, and it’s expecting strong demand for those offerings. CRM was already up 26% year-to-date, and it rose another 12% in early trading today.