The S&P 500 hit its 54th new high for the year yesterday, even as the Dow dipped a bit. Equities are flattish in the early going today along with Treasuries. The dollar is a bit lower, while crude oil, gold, and silver are higher.

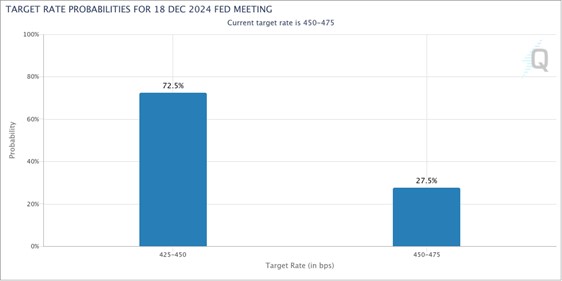

The Federal Reserve’s final meeting of 2024 is fast approaching. Ahead of the Dec. 17-18 gathering, markets are pricing in a 72% chance the Fed cuts interest rates by another 25 basis points. The current target range is 4.5% - 4.75%.

Fed Rate Cut Odds (December Meeting)

Source: CME FedWatch

Friday’s nonfarm payrolls report for November will play a big role in determining whether we get that cut or not. Economists estimate the US created 200,000 jobs last month, up from a paltry 12,000 in October. The unemployment rate is forecast to rise to 4.2% from 4.1%. The hotter the data, the less likely a cut – and vice versa, of course.

How much is Elon Musk’s SpaceX worth? As a privately held company, investors can’t track its value every second the markets are open. But periodic insider share sales that SpaceX enables provide a rough estimate – and the latest could value the firm at $350 billion. That’s up from around $210 billion in a sale earlier this year. For its part, publicly traded Tesla Inc. (TSLA) has surged 43% year-to-date.

The so-called “private credit” business is red-hot...and asset manager BlackRock Inc. (BLK) wants an even-bigger piece of it. The firm just said it would buy HPS Investment Partners for $12 billion. The firm manages around $150 billion, raising money from investors seeking higher yields and returns and using it to fund corporate loans and asset-backed financing deals. Private lenders are taking market share from traditional banks because they have become less-willing to extend credit to higher-risk borrowers.