Stocks and Treasuries are kicking off Thanksgiving week with a bang, while gold, silver, and the US dollar are starting it with a whimper.

President-elect Donald Trump named Scott Bessent, a hedge fund executive and Wall Street veteran, as his Treasury Secretary – and as you can see from the previous paragraph, Wall Street is happy with the pick. Treasury bonds rallied, the dollar slipped, and stocks rose, in part because Bessent is seen as someone who will lean against some of Trump’s more radical economic policies. It should also reduce the “Own Goal” risk I wrote and spoke about recently.

Few stocks have basked in as bright a post-election glow as Tesla Inc. (TSLA). Investors view Elon Musk’s close relationship with Trump as a positive for the company, with widespread assumptions he’ll face looser regulations in the new administration. But UBS Group isn’t buying it. The firm’s analysts said the fundamentals don’t justify TSLA’s $350 billion boost in market capitalization, and reiterated their “Sell” rating.

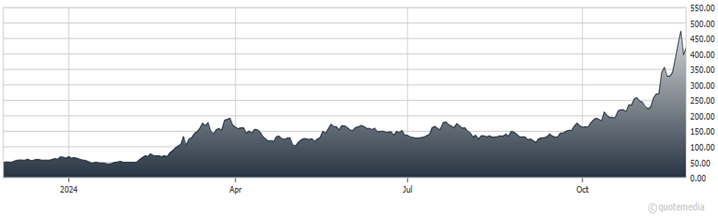

MicroStrategy Inc. (MSTR)

Investors who own Bitcoin are having a great year. But few are as attached at the hip to the cryptocurrency as the tech firm MicroStrategy Inc. (MSTR). Led by founder Michael Saylor, MSTR has snapped up around $32 billion in Bitcoin over the past four years. Its shares have surged 567% this year in response.

Now, Saylor wants to get even more aggressive. He wants to raise money in the stock and bond market, and plow that money into the cryptocurrency, too. Some investors and analysts think the company’s underlying software business doesn’t justify the gains though.