After a mixed day where the Nasdaq rose but the Dow fell, stocks are broadly higher in the early going today. Gold, crude oil, and the dollar are up a bit, too, while Treasuries are flat.

All eyes will be on Nvidia Corp. (NVDA) this afternoon when the semiconductor giant reports earnings for the fiscal third quarter. Investors also want to see what CEO Jensen Huang says about demand, production, and potential sales for its new Blackwell chip in Q4. The options market is pricing in a move of as much as 8% after the numbers come out, which would equate to a gain (or loss!) of up to $300 billion in market capitalization.

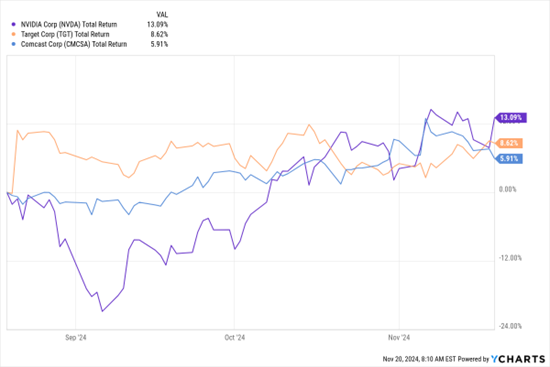

NVDA, TGT, CMCSA (3-Mo. % Change)

Data by YCharts

Walmart Inc. (WMT) delivered the earnings goods yesterday, while Lowe’s Cos. (LOW) did not. Today, Target Corp. (TGT) joined the latter camp – missing on sales in the most recent quarter and cutting its full-year earnings outlook to a range of $8.30 to $8.90 per share. It was previously expecting $9 to $9.70 in EPS.

In the media industry, cable giant Comcast Corp. (CMCSA) plans to spin off several of the networks that it acquired back in 2011 when it took over NBCUniversal. Channels like MSNBC, CNBC, Syfy, and Golf Channel will be consolidated in the new unit. Shares of that division will be distributed in a tax-free transaction to current Comcast holders.

Finally, Wall Street is paying close attention to Donald Trump’s search for a Treasury Secretary. Several other cabinet nominees are already generating controversy for other reasons, but his pick at Treasury is particularly important for financial markets.

As I noted this week in a MoneyShow YouTube Short, Treasuries have been selling off and “Own Goal” worries have been rising in the stock market. If Trump picks someone with significant market experience – especially someone who is seen as willing to lean against outsized debt and deficit growth – markets would likely rally.