The stock market has started to sour amid a rebellion in the interest rate markets. Equities sank yesterday and they’re sinking again in the early going today. Crude oil is also down, while gold and silver are flat along with the dollar.

We got a bit of an economic data deluge this morning. First, retail sales rose 0.4% in October. That was slightly hotter than the 0.3% gain economists were expecting. But if you strip out autos, sales were weaker than expected. Second, import prices rose 0.3%, more than the 0.1% that was forecast. Third, an index of New York-area manufacturing came in “hot” relative to forecasts.

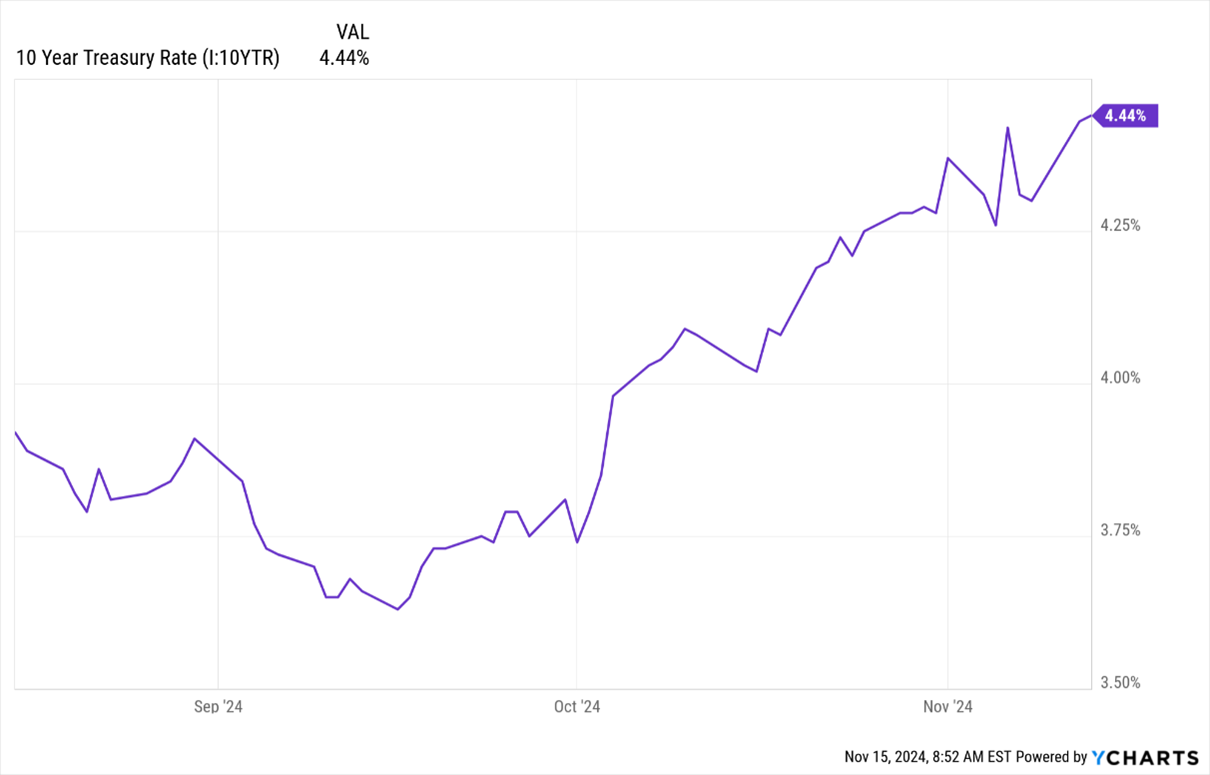

The net impact on markets was relatively muted. But Treasury yields have been anything but subdued in the last couple months. Since the Federal Reserve cut short-term rates by 50 basis points in September, long-term rates have actually surged. That move only accelerated after Donald Trump was elected because his policies are seen as more growth-friendly and inflation-inducing.

10-Year Treasury Note Yield (3-Mo. Chart)

Data by YCharts

The yield on the 10-year Treasury Note is now hovering around 4.44%, up from a September low of 3.61%. Rate futures markets are also only pricing in a 62% chance of another 25-basis point Fed cut at the Dec. 18 meeting this morning, down from 72% yesterday.

One reason: Fed Chairman Jay Powell and Boston Fed President Susan Collins both weighed in on policy over the last 24 hours. They shared a similar message: A December interest rate cut is NOT guaranteed and the Fed could slow the pace of its cuts overall to give policymakers more time to receive and analyze incoming data.

Former tech sector darling Super Micro Computing Inc. (SMCI) has crashed to earth in recent weeks amid accounting and regulatory questions. Now, a Nov. 18 Nasdaq deadline to file updated financials is looming. SMCI shares could be delisted from the exchange if the company can’t get current with its reporting. More than $55 billion in capitalization has been wiped out thanks to the stock's 85% plunge from its March high.