Markets keep breaking big, round-number records, with the S&P 500 closing above 6,000 yesterday and the Dow Industrials topping 44,000. Bitcoin blew through $89,000 overnight – and came within a whisker of topping $90K before pulling back.

But are the “Trump Trades” I’ve written about the last two weeks going to run out of steam soon? That’s what many on Wall Street are pondering after a rip-roaring rally for stocks, cryptocurrencies, and the US dollar (along with a slide in oil prices and Treasury bonds).

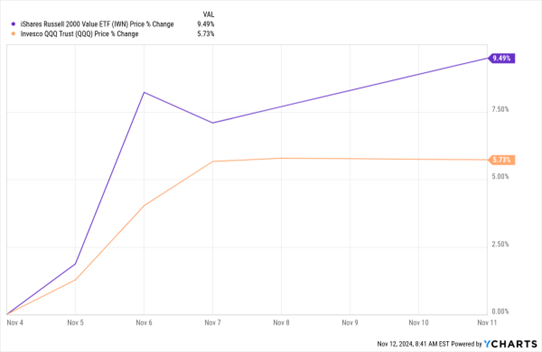

IWN Vs. QQQ

Data by YCharts

Still, the recent rise in small caps, value stocks, and non-tech-sector names is encouraging. That’s because it shows investors are still looking for and pivoting to new winners, helping make this a broader market advance. The iShares Russell 2000 Value ETF (IWN) is up 9.5% since the day before the election, compared with a 5.7% rise for the Invesco QQQ Trust (QQQ).

On the earnings front, Shopify Inc. (SHOP) is benefiting from Artificial Intelligence-related efforts in its e-commerce business. The company helps businesses sell goods and services online, and its AI service Sidekick is winning converts from its customer base. The firm said Q4 revenue would rise in the mid-to-high-20% range, well above the 22.7% expected by analysts. Shares surged more than 17% in early trading.

Home improvement retailer Home Depot Inc. (HD) also managed to beat estimates thanks to hurricane-related sales and improved demand for seasonal products. The company still expects same-store sales to fall 2.5% for the year, but that’s better than the 3% to 4% decline it previously forecast. HD rose modestly in early trading.