Tech stocks, Treasury bonds, and gold and silver bounced yesterday after “Trump Trades” were partially unwound. But they’re mostly flat to lower so far this morning. Crude oil is down as well, while the dollar is flattish.

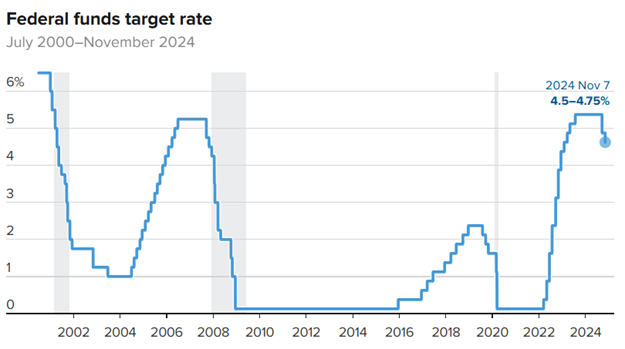

The Federal Reserve cut interest rates by 25 basis points, as expected, at yesterday’s meeting. The move by Chairman Jay Powell & Co. leaves the federal funds rate in a new range of 4.5%-4.75%. In his post-meeting press conference, Powell said the Fed wants to keep “recalibrating” policy because inflation has come down and policymakers don’t want growth to slow too much. But he did leave the door open SLIGHTLY to skipping a cut at the December meeting just to give the Fed time to see how the economy is unfolding at year-end and the start of 2025.

Source: CNBC.com

Exactly how much money flowed into US markets after news broke that Donald Trump won the election? Roughly $20 billion in US equity funds on Wednesday alone, according to Bank of America Corp. (BAC) estimates. That was the most money thrown at US stock funds in a single day in five months. For the week through Nov. 6, inflows totaled $32.8 billion.

Finally, China unveiled key details of its massive stimulus efforts. The central government said it would help refinance $1.4 trillion worth of “hidden” debt that many local governments racked up during the nation’s economic boom – and are struggling to repay now. China hopes the move will help regional governments focus more on growth-boosting measures than simply repaying past debts.

That said, Chinese officials are worried that if Trump follows through with aggressive tariffs on Chinese goods, it could hurt the nation’s exports and economy. So, they’re keeping some stimulus plans in reserve for after Trump’s January 2025 inauguration. The US-traded iShares China Large-Cap ETF (FXI) has surged 40% year-to-date on the back of China’s various announcements, but it’s still down 12% in the past five years.