The 2024 presidential election is over – and former President Donald Trump has won. The Republicans also regained control of the Senate, while control of the House of Representatives won’t be known for a few days due to the closeness of some races.

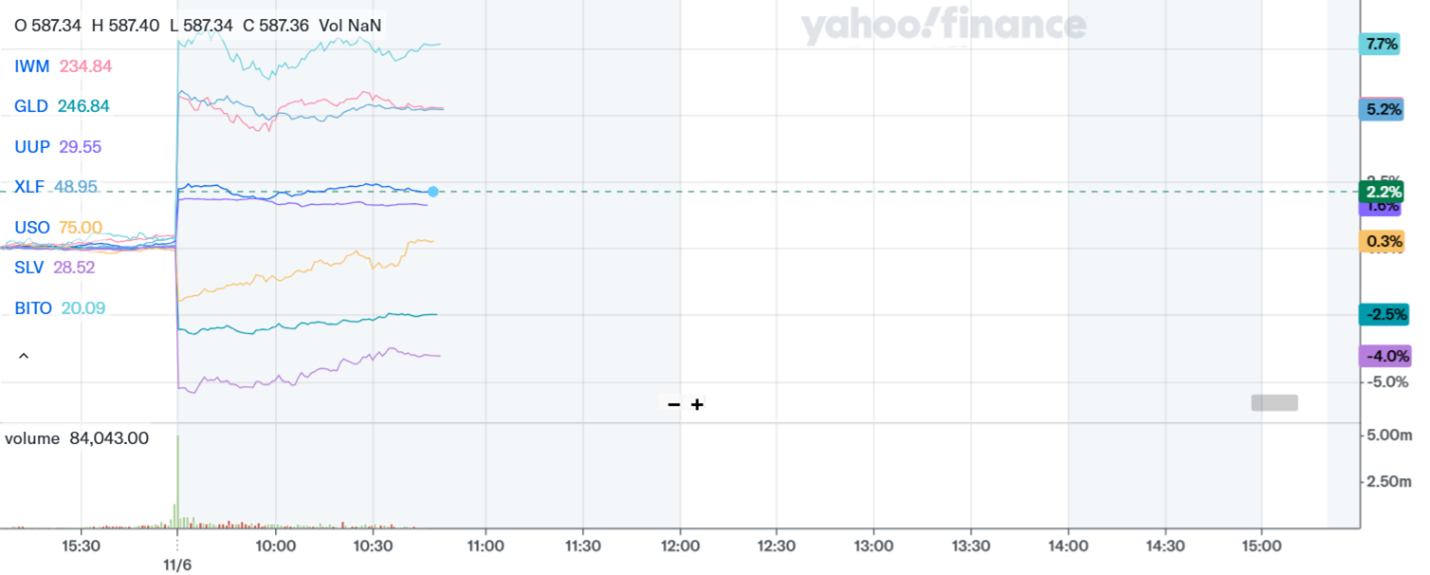

Markets reacted to the news with a flurry of “Trump Trades.” Stocks soared, with small caps and groups like financials leading the way. The dollar surged. Treasury bonds tanked. Oil prices fell early, before bouncing a bit. Gold and silver dropped, while Bitcoin jumped. ETFs that track those asset classes are charted below.

SPY, IWM, GLD, UUP, XLF, USO, SLV, BITO

(Post-Election % Change)

I wrote on Monday about why some of these moves were already happening pre-election – and why they were likely to get “turbocharged” in the short term by a Trump victory. But it comes down to Wall Street pricing in less regulation of both the traditional banking industry and the cryptocurrency space, plus more domestic oil drilling and production.

Trump is also likely to push bigger tax cuts that will fuel yawning deficits (and more debt issuance to cover them), while taking a tougher line on trade policy and tariffs. Some of the bond market selloff stems from expectations that Trump’s policies will be more inflationary – an ironic twist considering many voted for him due to their angst over Biden-era inflation.

Next up in this busy week for markets: The latest Federal Reserve meeting. Policymakers will likely cut interest rates by another 25 basis points tomorrow. But recent economic data has been fairly solid. The Trump win could lead to enacting of growth-friendly and inflation-spurring policies, which might make Fed members reluctant to signal a series of rate cuts. The Fed meets one more time in December this year, then concludes its first meeting of 2025 on Jan. 29.