Markets are swinging on last-minute election news and polling results, though stocks are mostly holding Friday’s gains. The dollar is dropping, while Treasury bonds are rallying. Crude oil is rising on geopolitical fears.

The presidential election is less than 24 hours away...and polling remains as tight as ever. It’s entirely possible we won’t know whether Kamala Harris or Donald Trump won by Tuesday night – or even the end of the week. Various betting markets where people can put money down on the election are split as to who will win. Some “Trump Trades” (long dollar, short government bonds) were partially reversed overnight.

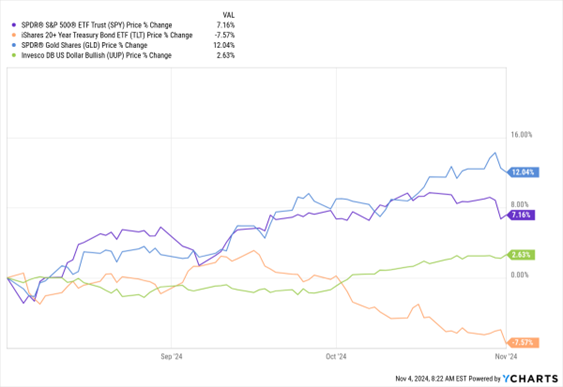

SPY, TLT, GLD, UUP (3-Month % Change)

Data by YCharts

For their part, shares of Trump Media & Technology Group Corp. (DJT) tanked last week – but remain well above their late-September lows. Some investors have bought, sold, or shorted the stock depending on the latest news on how Trump is faring on the campaign trail.

Don’t forget: There is also a Federal Reserve meeting this week! It will conclude one day later due to the election, with the usual Wednesday policy announcement pushed to Thursday instead. Rate futures markets are pricing in a near-100% chance the Fed will cut rates by 25 basis points to a new range of 4.5%-4.75%. They’re also currently forecasting an 82% chance of a second cut at the meeting that concludes Dec. 18.

Crude oil is rallying on news that Iran may launch a more aggressive strike in response to Israel’s Oct. 26 airstrikes on the country. The tit-for-tat missile and airplane attacks could ultimately threaten oil supply from the Middle East, though that hasn’t happened yet. US production is also much higher now than during past periods of regional turmoil, helping keep prices from rising too far.