Stocks are taking a bit of a breather this morning after the S&P 500 hit its 47th record high of 2024 on Friday. Gold and silver are powering higher again though, while crude oil is rising, too. Treasuries are lower, while the dollar is flat.

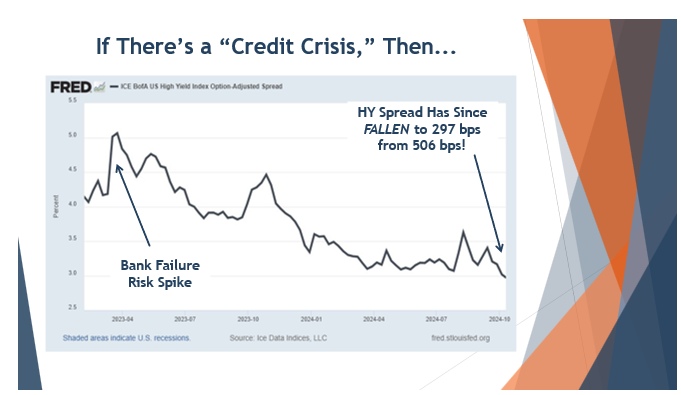

Credit market conditions have been a key focus of the market presentations I’ve given over the past year, including last week at the 2024 MoneyShow Orlando. I’ve noted that credit spreads – or the difference between yields on riskier corporate debt and yields on underlying Treasuries – have been steadily falling since early 2023. And I’ve said that was supportive of stocks because it means default fears are easing and corporate borrowing costs are dropping.

Today, the Wall Street Journal is covering the news in a piece called “Red-Hot Bond Market Powers Wave of Risky Borrowing.” The article notes that the high-yield bond spread sank to 285 basis points recently, close to the 14-year low originally hit in 2021. Junk bond issuers also raised $110 billion in the month of September, the third-highest total since the research firm PitchBook LCD started tracking the data in 2005.

We’ll have to see if this becomes too much of a good thing – or in other words, if the bond market gets TOO frothy. But for now, it’s just another bullish driver for the markets. Here’s the slide I shared in Orlando, by the way.

Leave it to Goldman Sachs Group Inc. (GS) to try raining on the bulls’ parade. Firm strategists led by David Kostin just published research suggesting the S&P 500 will return only 3% per year over the next decade. That would be a HUGE step down from 13% over the past decade, and the long-term average of 11%. They also said Treasuries would have a 72% chance of outperforming stocks during that stretch.

Of course, it’s worth noting that both stocks AND bonds have done fairly well in the past 12 months. The S&P 500 ETF Trust (SPY) is up 39% in the past year, while the iShares 20+ Year Treasury Bond ETF (TLT) is up 18%. Take that Goldman!