Stocks are pulling back this morning after hitting record highs in recent days. Meanwhile, gold and silver are higher along with Treasuries and the dollar, while crude oil is spiking on Middle East conflict fears.

Dockworkers around the US east and gulf coasts have walked off their port jobs as part of the first International Longshoreman’s Association strike in decades. The union represents around 45,000 workers. They’re seeking a 77% increase in wages spread out over the next six years, while employers have so far offered only 50%, plus increased benefits.

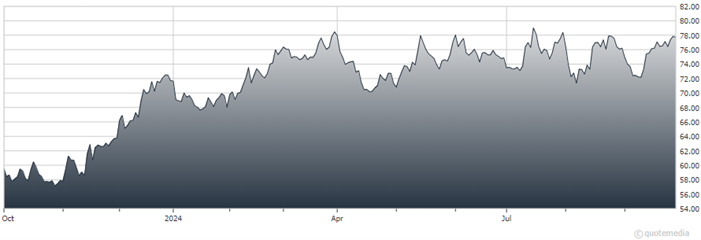

Depending on how long the strike lasts, the cost of importing all kinds of goods, including food, heavy machinery, furniture, and toys could rise notably. Other imports could simply not make it to wholesalers and retailers at all. That said, the SPDR Retail ETF (XRT) has actually risen around 2% in the last month – despite plenty of “strike talk” floating around in the past few weeks.

SPDR Retail ETF (XRT)

Israel followed up on its recent air attacks targeting Hezbollah officials with a ground invasion into Lebanon overnight, albeit a limited one so far. One army division of around 10,000 soldiers is involved in “limited, localized, targeted raids” in the country, according to Israel’s military.

Israel has been striking back at all of Iran’s “Axis of Resistance” groups around the Middle East in recent weeks. For a few weeks, crude oil markets took the news in stride. US WTI futures traded around or just below $70 a barrel for the last month. But they spiked today after Iran rained missiles down on multiple targets in Israel.

Finally, CVS Health Corp. (CVS) has retained a team of bankers to help it review its operations, and may break itself up to boost shareholder value, according to Bloomberg. CVS operates its namesake chain of drug stores, as well as a health insurance division (it acquired Aetna back in 2018 for $70 billion). But falling margins in the pharmacy business, and rising medical costs in its insurance business, are crimping profit. CVS shares have fallen 20% year-to-date in response.