Stocks soared yesterday, with the S&P 500 and Dow Jones Industrial Average punching through resistance to hit record highs. Precious metals also rose. This morning, equities are mixed while gold just rose to a fresh all-time high above $2,640 an ounce. Treasuries and the dollar are flattish.

The Federal Reserve did it! They went big, cutting the federal funds rate by 50 basis points rather than opting for a smaller 25-bp move. Plus, Chairman Jay Powell made clear in the post-meeting press conference that several MORE rate cuts are coming in the remainder of 2024 and 2025.

So, what do I think – and what comes next? First, the 50-bp cut didn’t surprise me at all. I said for weeks I expected it given developments on the labor market and inflation front. Second, I shared with MoneyShow viewers and readers like you that the initial “Sell the news” reaction in markets likely wouldn’t persist (See this YouTube Short we fired out on our MoneyShow channel or these comments on X).

Sure enough, equities and precious metals took off like a rocket yesterday. While we may be overbought in the short term, and due for a breather, a few things are clear. The soft landing looks on track. The Fed has gone from being a headwind to tailwind. Inflation is LESS THAN HALF what it was at the July 2022 peak.

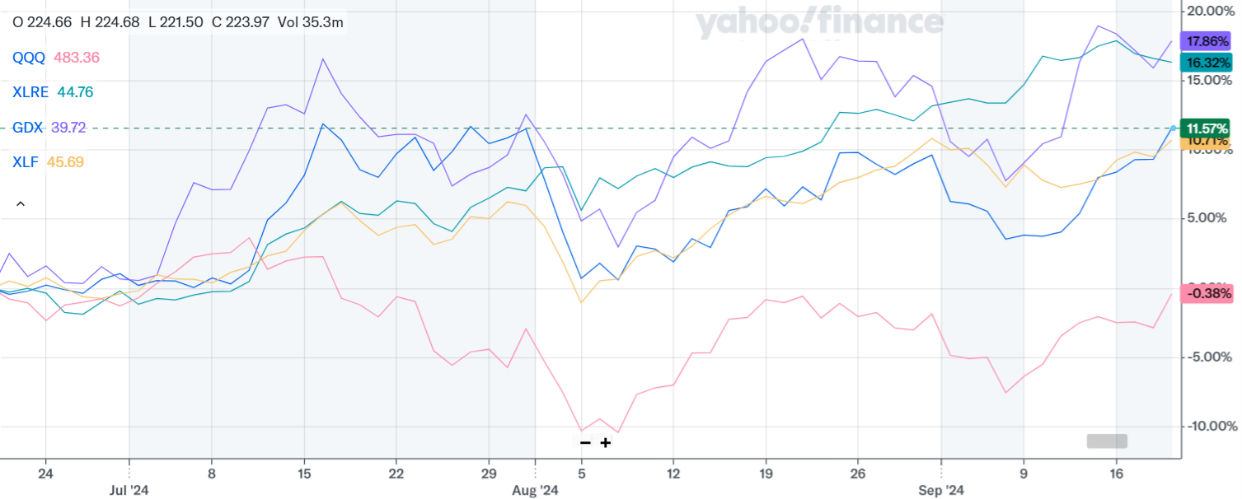

IWM, QQQ, XLRE, GDX, XLF (3-Mo. % Change)

Plus, the rotation into new winners that began in July is continuing. That means we’re seeing a BROADER market advance. Just take a look at the chart above showing the three-month percentage change for various ETFs. You can see the biggest gains during that time were racked up by funds like the VanEck Gold Miners ETF (GDX), up around 18%, and the Real Estate Select Sector SPDR Fund (XLRE), up 16%. The Invesco QQQ Trust (QQQ) is essentially unchanged.

So, yes, I (still) think investors should...BE BOLD!