Stocks are in a holding pattern ahead of today’s momentous market news. Gold and silver are mixed, while crude oil is down a bit along with Treasuries. The dollar is flat.

It’s here, folks. The day the Federal Reserve will cut interest rates for the first time in four-and-a-half years. That last cut came at the outset of the Covid pandemic in March 2020, and in some ways, it feels like forever ago. But we’re on the cusp of a whole new cycle – one where rates will likely get cut multiple times over a span of up to a year (or more).

The only question is whether Fed Chairman Jay Powell and crew cut the federal funds rate by 25 basis points or 50 today. I’m in the “50 camp,” for reasons I’ve shared with MoneyShow conference attendees during live presentations and on-site conversations recently (Editor’s Note: You can get that kind of guidance by joining us at the 2024 MoneyShow Orlando!)

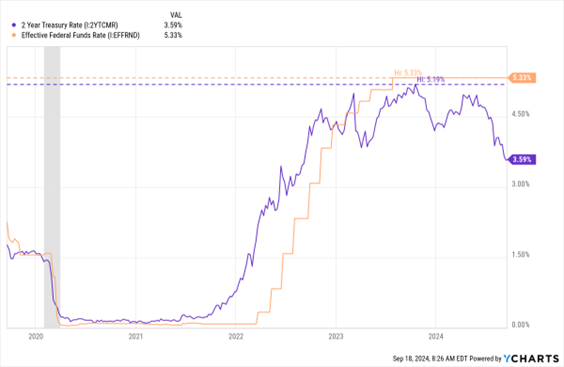

As for the future? There are various ways to track how many cuts the market is anticipating. But this chart comparing the yield on the 2-year Treasury Note and the effective funds rate can help.

2-Year Treasury Yield Vs. Effective Federal Funds Rate

Data by YCharts

You can see how the 2-year “anticipated” the hikes that were coming in 2022, with its yield rising several months prior to the first Fed move. You can also see how the yield has been falling in anticipation of the cuts that are starting today. At 3.59% recently, the 2-year yield has dropped 160 bps from its peak – and may fall further in the weeks ahead.

Longer-term rates have also been sliding, including the rate on the average 30-year fixed mortgage. It sank another 14 bps to 6.15% in the most recent week. That was the lowest found by the Mortgage Bankers Association since September 2022. In fact, the average rate has dropped for seven straight weeks – something that hasn’t happened since a stretch in 2018-2019.

Still, cheaper money won’t come fast enough for one iconic company. Tupperware Brands Corp. (TUP) filed for Chapter 11 bankruptcy following a long struggle against rivals who produced cheaper or more environmentally friendly food containers. Sales have been falling for several quarters, while rising costs tied to the post-pandemic environment drove losses up.