Stocks notched a nice comeback last week, but they’re mixed this morning. Gold is taking a breather after hitting record highs, while crude oil and silver are up a bit. Bonds are flat, while the dollar is down.

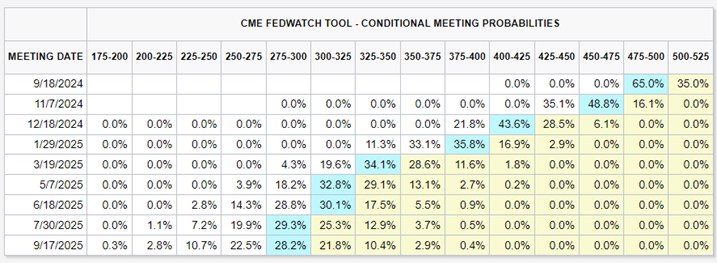

This week is for all the marbles – if you’re a Federal Reserve policymaker, that is. The Fed meets on Tuesday and Wednesday and it WILL cut interest rates for the first time since 2020. The question is, do they lower the federal funds rate by 25 basis points...or 50? The funds rate is currently set in a range of 5.25% - 5.5%. Various articles from plugged-in Fed reporters suggest the decision is a tossup. Meanwhile, rate futures markets were recently putting about 65% odds on a 50 bp cut.

Regardless of how the cutting cycle starts, it’s likely to continue for some time. Markets are pricing in around 250 bps of cuts in the cycle that will start Wednesday and likely last well into 2025 – as you can see in the CME FedWatch chart above. The light blue boxes show where markets are placing the highest odds of the fed funds rate being at each of the meetings between now and September of next year.

Meanwhile, hope for aggressive Fed cuts is helping bonds power ahead. The iShares 20+ Year Treasury Bond ETF (TLT) has surged more than 9% in the last two months. Lower-rate chatter is also helping OTHER market sectors catch up to the Magnificent Seven.

This Bloomberg story notes that while the Mag 7 names have lost about 5% since the July S&P 500 peak, the broader average has slipped less than 1% during the same time. The reason? More sectors and stocks are perking up. I wrote about how I expected this, why it’s healthy, and why it should continue in the months ahead in my MoneyShow Chart of the Week column from July 29 HERE.