The first trading day of September did NOT go well for the bulls. Stocks finished broadly lower with the Nasdaq shedding more than 3% and the Dow losing 600-plus points. We’re trying to stabilize in the early going today. Crude oil, gold, and silver are flattish, as are Treasuries and the dollar. Bitcoin is quietly back near its early-August lows.

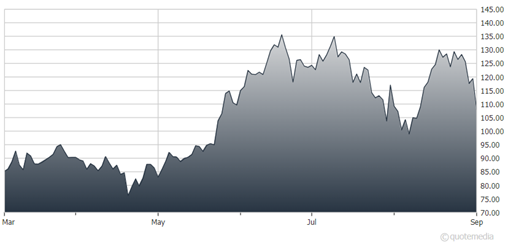

Semiconductors were the “stars” of the market horror show on Tuesday, with the Philadelphia Semiconductor Index losing 5.4%. That made it the worst day for chip names since the midst of the Covid-19 meltdown in March 2020. Nvidia Corp. (NVDA) slumped almost 10%, losing $279 billion in market cap on the day. Concern about the sustainability of the AI boom combined with worries about a Justice Department antitrust investigation drove the declines.

Nvidia Corp. (NVDA)

Oil is trying to make a stand today after media leaks suggesting OPEC+ is rethinking plans to boost output in October. Saudi Arabia and Russia have reportedly been pushing to add back 180,000 barrels per day in production. The cartel originally slashed production in 2022 to cope with weaker demand and elevated supply, and the partial reversal wasn’t expected to hurt pricing. Alas, the market disagreed – with oil falling to a nine-month low yesterday.

Lastly, the Nordstrom family is going shopping...at Nordstrom Inc. (JWN). The department store company formed a committee of directors earlier this year to evaluate options for its future. Now, a group backed by Erik and Peter Nordstrom have submitted an offer to take JWN private. The price is $23 per share in cash – right around where the stock closed yesterday.