Stocks picked up right where they left off last week, rallying again yesterday. They’re subdued this morning, but gold is anything but – recently hitting another all-time high around $2,568 an ounce. Silver is up, too, along with Treasuries. The dollar is down modestly.

Lowe’s Cos. (LOW) joined Home Depot Inc. (HD) in warning about the impact of a slowdown in home improvement activity on sales and profit. The retailer said same-store sales dropped a greater-than-expected 5.1% in the second quarter, while adjusted earnings per share slid 10.1%. It also said full-year results would miss prior targets.

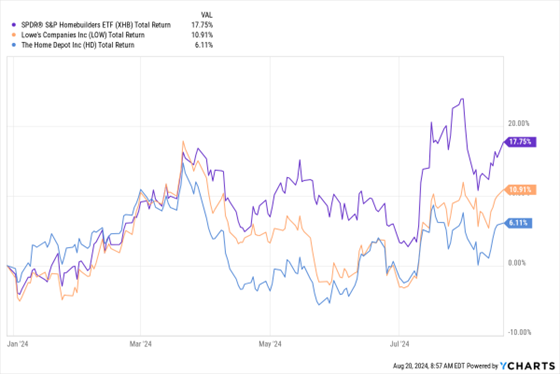

Still, LOW shares have rallied almost 13% in the last month. Why? Lower interest rates are spurring optimism about a housing market rebound. Thanks to its recent rally, for instance, the SPDR S&P Homebuilders ETF (XHB) is now up 18% year-to-date. Long-abandoned Real Estate Investment Trusts (REITs) are also rallying back nicely.

XHB, LOW, HD (YTD % Change)

One thing that may prompt more-aggressive Federal Reserve rate cuts: Cooling labor market conditions. A New York Fed survey on labor market expectations weakened notably in July, with 4.4% of respondents saying they expect to lose their jobs. That was up from 3.9% in the same month of 2023, and the highest in a decade.

Paramount Global (PARA) has been one of the casualties of the streaming wars, and now it’s close to being taken off the battlefield. Seagram Co. heir and media executive Edgar Bronfman Jr. bid $4.3 billion to secure control of the firm, topping a competing offer from Skydance Media. In addition to buying a controlling stake in the firm from the Redstone family’s holding company, he’ll invest another $1.5 billion in the firm. PARA shares have lost 70% of their value in the last three years.