Stocks surged again yesterday, though they’re stopping to catch their breadth in the early going here on Friday. Gold is powering upwards, though, while crude oil was recently down more than 2%. Bonds are a bit stronger, while the dollar is a bit weaker.

Yen carry trade “disaster,” we hardly knew ya! Just a couple of weeks after stocks began to plummet on interest rate fears, currency market fluctuations, and tech earnings doubts, we’re back near old highs. The S&P 500 closed yesterday at 5,543, regaining all the ground it previously lost in August – and putting it only 2.1% below its July high.

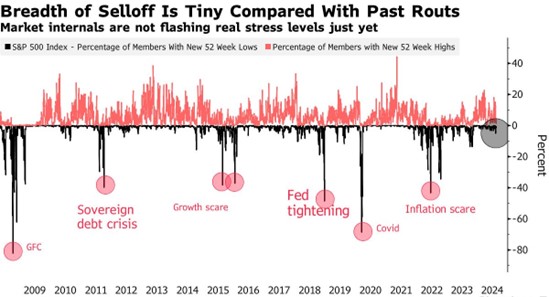

Moreover, Bloomberg notes that just 5% of S&P 500 companies hit 52-week lows in the most recent selloff. That compared to sizable double-digit percentages in several other pullbacks since the Great Financial Crisis. I’d call that just another sign that “Be Bold” remains a solid investment approach.

Source: Bloomberg

One catalyst for yesterday’s rampage to the upside: Stronger retail sales and jobless claims data. Sales jumped 1% in July, compared with expectations of a 0.3% gain. Initial jobless claims also dropped to 227,000 when economists anticipated a reading of 235,000. Those reports allayed concerns about economic growth, leading to renewed outperformance in things like semiconductors and small cap stocks.

Finally, the Federal Reserve confirmed that Chairman Jay Powell will deliver a headlining speech at the Kansas City Fed’s Jackson Hole, Wyoming retreat next Friday. Officials from the US central bank and its foreign counterparts have frequently used the annual August gathering to give markets a heads up about future policy moves or important shifts in thinking. Right now, the question isn’t IF the Fed will cut rates at its Sept. 17-18 meeting, but by HOW MUCH: 25 basis points or 50.