Stocks were mixed yesterday, but they’re catching a bid today on tamer inflation. Gold is flat after rocketing to a record high on Monday, while crude oil is modestly lower. The dollar is unchanged, while Treasuries are rallying.

Investors got good news on the inflation front this morning, with the core Producer Price Index (PPI) coming in cooler than expected in July. The ex-food and energy reading was unchanged last month, compared with forecasts for a 0.2% rise. That lowered the year-over-year core wholesale inflation rate to 2.4% from 3% in June. Headline PPI rose 0.1% on the month, in line with forecasts. But even there, the YOY rate slipped to 2.2%

Retailing giant Home Depot Inc. (HD) warned that same-store sales will fall 3% to 4% this year, rather than around 1% as previously expected. The home improvement giant said consumers are increasingly reluctant to take on big projects like kitchen or bath remodeling, putting pressure on the firm’s top and bottom lines. HD shares slumped in response.

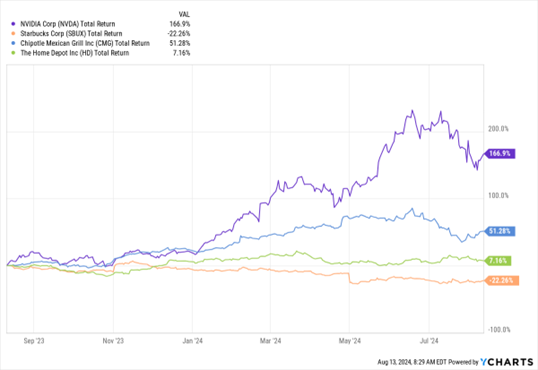

NVDA, SBUX, CMG, HD (YTD % Change)

Data by YCharts

Nvidia Corp. (NVDA)...top “Rebound” play? That’s what Bank of America analyst Vivek Arya just dubbed the formerly on-fire semiconductor stock. Arya argued that seasonal headwinds will fade soon and that volatility will subside in the wake of the firm’s Aug. 28 earnings report. Still, investors have questions about the rollout timetable for NVDA’s next-generation Blackwell chip – one reason the stock is down 19% from its mid-June peak.

Finally, coffee giant Starbucks Corp. (SBUX) named Brian Niccol as its new CEO. The current head of Chipotle Mexican Grill Inc. (CMG) will replace Laxman Narasimhan, who is stepping down immediately. Activist investors have been circling SBUX, pushing the firm to find ways to boost sales and improve operations. Niccol is only the second SBUX CEO to come from outside its own ranks. SBUX shares are down 19% year-to-date, while CMG shares are up about 22%.