After a lousy finish to a lousy week, stocks are relatively quiet this morning – despite the political earthquake that struck over the weekend. Gold, silver, and crude oil are all a bit lower along with the dollar. Treasuries are flat.

Now, about that earthquake. President Joe Biden gave in to increasing pressure from voters, donors, Democratic members of Congress, and others on Sunday, bowing out of the 2024 presidential race and throwing his weight behind Vice President Kamala Harris.

It isn’t 100% clear Harris will be the Democratic nominee. Some Democratic leaders would prefer an accelerated, “mini-primary” process involving multiple contenders ahead of the party’s August convention in Chicago. But she has the most momentum – not to mention access to the war chest of money the Biden campaign had already amassed. More than $50 million poured into the campaign on Sunday, the most in any day since the last election cycle.

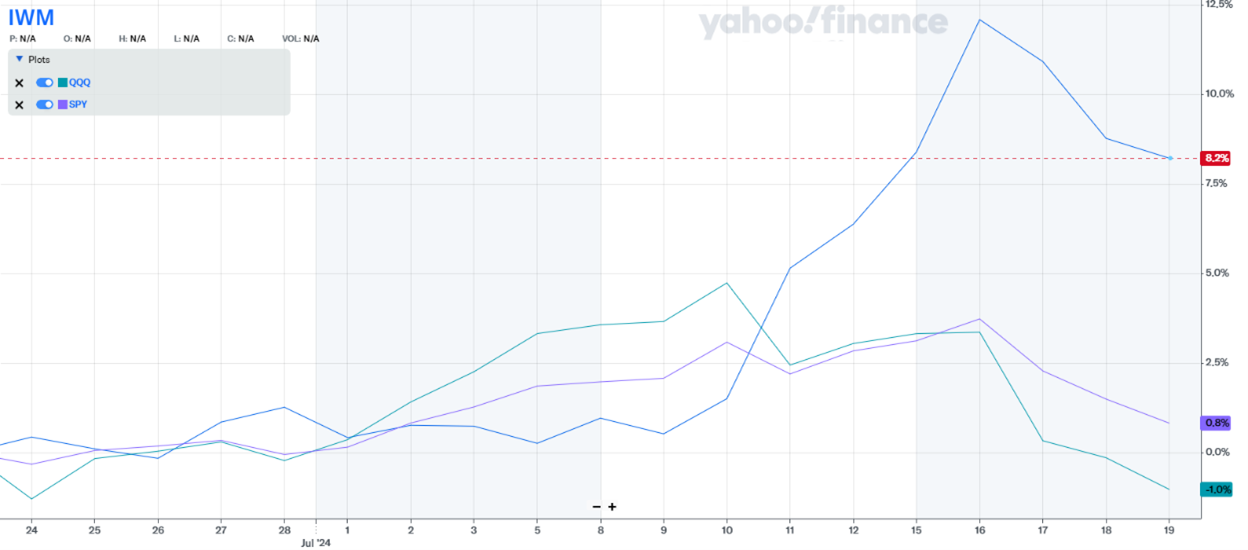

IWM, QQQ, SPY (1-Month % Change)

Source: Yahoo Finance

Meanwhile, investors will be watching closely to see if July’s mega-market-rotation continues. In a recent seven-day trading stretch, the Russell 2000 outperformed the S&P 500 by the most since at least 1986. Value stocks outperformed growth stocks by the greatest margin since 2001.

On the economic front, we’ll get data on existing home sales Tuesday, new home sales on Wednesday, and durable goods orders and GDP on Thursday. Friday will bring the personal income and spending figures for June – along with an important reading on inflation that the Federal Reserve pays close attention to.

It’s highly unlikely the Fed will cut interest rates at the meeting that concludes next Wednesday. But rate futures markets are pricing in a 92% chance the Fed DOES move at its September meeting. They’re also priced as if we’ll get another cut (and possibly two) before the end of the year. The final Fed meetings of 2024 conclude on Nov. 7 and Dec. 18.