After rallying on the back of the Magnificent Seven for months, markets are rallying on the backs of a whole host of NEW leaders. The Dow Industrials jumped 742 points yesterday, the biggest gain since June 2023 and one that pushed the index to a fresh all-time high. Meanwhile, the Russell 2000 surged more than 3%. That boosted its one-week gain to 11%.

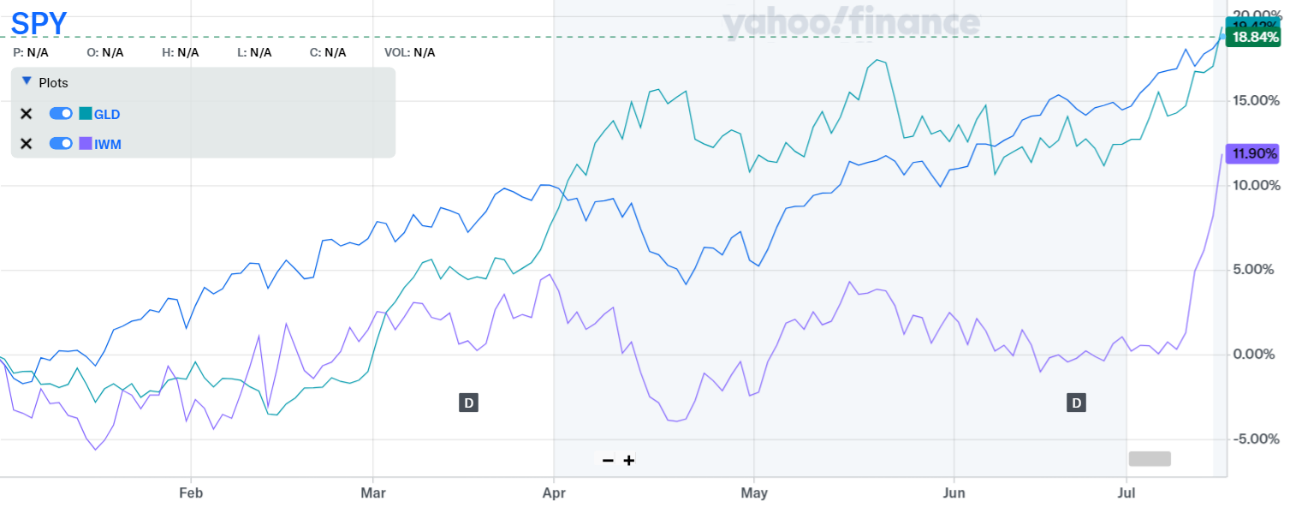

In the early going today, equities are pulling back a bit. But crude oil is up. The same goes for gold, which is trading at fresh all-time highs around $2,480 an ounce. The SPDR Gold Shares ETF (GLD) is now up more than 18% year-to-date, right in line with the S&P 500 ETF Trust (SPY). While the iShares Russell 2000 ETF (IWM) isn’t there yet, it’s playing “catch up” fast!

SPY, IWM, GLD (YTD % Change)

Source: Yahoo Finance

Semiconductor stocks are taking it on the chin thanks to threats from the Biden administration to tighten curbs on the export of chipmaking equipment to China. Tough talk from Republican candidate Donald Trump on China suggests relations may only get worse if he wins the November election. The ongoing rotation of money AWAY from “Big Tech” and TOWARD small caps and other sectors is also hurting stocks like ASML Holding NV (ASML) and Micron Technology Inc. (MU).

As someone who has followed markets and interest rate policy closely for a quarter-century, I know a “successful” currency market intervention when I see one. The Bank of Japan had been unsuccessfully fighting the currency markets and losing for months. But it looks to have switched tactics and intervened last week to drive the yen higher when it actually had fundamental news on its side (the weaker-than-expected CPI inflation report). Those kinds of interventions are historically much more successful.

Today, the BOJ appears to be piling on – and yen bears are running scared. The yen just hit a two-month high against the dollar, after weakening to its lowest level since the 1980s earlier this year. Eventually markets may successfully challenge the BOJ again…just not right now. The action could help to calm fears of the yen carry trade “blowing up,” another positive for equities.