The bulls were on parade yesterday, with aggressive buying helping the S&P 500 close above 5,500 for the first time and the Nasdaq Composite Index top 18,000. The Dow Industrials lagged a bit, but still finished in the green.

This morning, stocks are flattish along with crude oil and Treasuries. The dollar is lower, while gold and silver are higher. As a reminder, the stock and bond markets close early today, at 1 p.m. and 2 p.m. Eastern, respectively. Both are closed tomorrow for the Fourth of July holiday.

Federal Reserve Chairman Jay Powell helped ignite yesterday’s rally by expressing optimism on the inflation front. Specifically, he suggested “we’re getting back on a disinflationary path.” He also discussed how the job market is cooling – but not collapsing – at the European Central Bank Forum on Central Banking in Portugal.

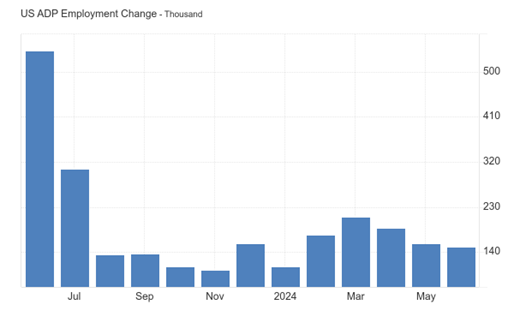

Source: Trading Economics

Speaking of the job market, we won’t get “official” data from the Labor Department until Friday. But today's ADP Employment report showed job growth cooling to 150,000 in June, below the average forecast of 160,000.

Rate futures markets continue to price in about a 60% chance of an initial 25 basis point cut at the Fed’s September meeting. They see only a 7% chance of rates still being in their current range of 5.25% - 5.5% by December, according to CME FedWatch.

Editor’s Note: Top Pros’ Top Picks will include our latest MoneyShow MoneyMasters Podcast only on Thursday, July 4 due to the Independence Day holiday. We will not publish at all on Friday, July 5. Our normal schedule will resume on Monday, July 8. My entire team and I wish you the very best Fourth of July!