Markets are mostly in wait-and-see mode ahead of key jobs data. Stocks are modestly weaker along with gold and silver. Crude oil is higher along with Treasuries, while the dollar is flat.

While we won’t get “official” labor market data for June until Friday, evidence suggests the job market is cooling. The question is, will the Federal Reserve adjust policy further because of it? Some well-regarded economists like Jan Hatzius of Goldman Sachs recently suggested the job market is at or near an “inflection point.”

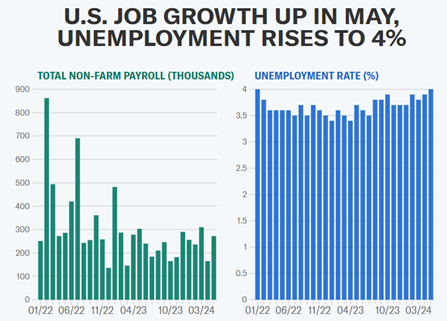

Economists expect job growth decelerated to 195,000 last month from 272,000 in May, while the unemployment rate held steady at 4%. That 4% reading was up from 3.9% a month earlier and the highest since January 2022.

Source: Yahoo Finance

Looking for more evidence the alternative and/or private market investing trend is strong? Then you’ll find it in this week’s $3.2 billion acquisition of Preqin by BlackRock Inc. (BLK). Preqin compiles data on 190,000 funds, 60,000 managers, and 30,000 investors in the private market, which is used by money managers, advisors, and others in the industry.

BLK also bought Global Infrastructure Partners earlier this year for $12.5 billion. That firm manages $100 billion in funds committed to things like energy and transportation infrastructure projects. The alternatives market is expected to grow to $40 trillion in assets by the end of the 2020s.

Finally, a New York Times story today talks about how many fast-food restaurant chains are experimenting with “no seat” models in select locations. The idea? You order your food on your mobile phone or through a delivery service. Then you grab it at the counter and go – or the courier does for you – and no one spends any length of time onsite.

The story focuses on privately held Chick-fil-A. But as tech visionary (and MoneyShow conference speaker) Howard Tullman has said, this is just one example of how technology is revolutionizing a wide range of industries. That, in turn, has implications for real estate companies, individual investors in tech and restaurant stocks, and more.