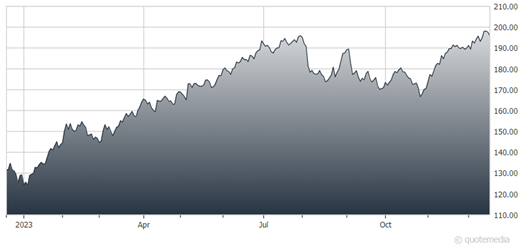

Stocks continue to grind higher into year end, with modest gains yesterday and more being accumulated this morning. Most other markets, including precious metals, oil, and Treasuries, are trading around the flatline.

In the post-pandemic world, more Americans than ever own stocks. That’s the finding of the Federal Reserve’s latest consumer finances study. Roughly 58% of US households now own stocks directly in brokerage accounts or indirectly through retirement vehicles like 401(k) accounts. That was a big leap from 53% in 2019, the last time the Fed conducted its every-three-years survey.

As we all know now, many neophyte investors took their COVID “stimmy” checks and plowed them into stock and options trading accounts. They used that money to speculate in all kinds of fast-moving names, helping fuel the “meme stock” boom. That, in turn, was followed by a meme stock bust.

But the data suggests many investors are sticking around in this post-frenzy market. It’s also worth noting that Americans have one of the highest equity ownership rates in the world. Households here keep about 39% of their money in stocks, second only to Estonia in a multi-nation study conducted by the Organization for Economic Cooperation and Development (OECD) in 2022.

Apple (AAPL)

Buying an Apple Watch for someone as a present this holiday season? Then don’t wait for the last minute! The giant tech company is planning to pull its newest Apple Watch models from its website and store shelves in the next few days due to a patent dispute with Masimo Corp. That company launched a patent fight with Apple, saying the company’s Watch uses technology it developed to measure oxygen saturation and communicate that information to Watch wearers.

Apple is trying to come up with software-based workarounds to avoid running afoul of an International Trade Commission ban that would otherwise take effect on Christmas Day. Apple could also still reach a last-minute settlement with Masimo to prevent its $17 billion Watch business from hitting any snags.