Good post-holiday-Monday-morning! Stocks finished last week off mixed, and they’re under a bit of pressure in the early going here. Gold and silver are notably higher, though, while crude oil is modestly lower. The dollar and Treasuries are flattish.

One reason precious metals have been perking up – and the dollar has been trading around a three-month low – is the interest rate outlook. The Federal Reserve started HIKING rates 20 months ago...but rate futures markets are now pricing in multiple rate CUTS in 2024. All else being equal, that’s bad for the greenback but good for gold and silver. The yellow metal is trading very close to an all-time high.

Dividend-focused investing tends to perform well in the long term. But as this Bloomberg story notes, extreme bets over the past year on ETFs loaded with higher-yielding utilities and financials haven’t worked out. More than $60 billion flowed into dividend-focused ETFs after the market mess of 2022. But many of the stocks those ETFs hold have underperformed non-dividend or low-dividend technology names.

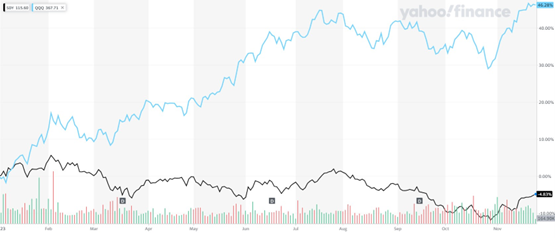

The SPDR S&P Dividend ETF (SDY) yields a market-beating 2.9%, but it has shed around 5% year-to-date. That lags far behind the 46% return for the Invesco QQQ Trust (QQQ), which yields just 0.6%, as you can see in this comparative chart.

QQQ Vs. SDY (YTD Return)

Finally, there was a bit of modest détente in the Hamas-Israeli war over the weekend. Israel agreed to a temporary cease-fire in return for Hamas releasing dozens of hostages. The cease fire could expire in the next 24 hours – or it could be extended in return for more releases. Diplomats from several countries are pushing for the latter scenario, but it’s unclear how Israel will act.