Yes, we’re closing out a lousy September. But yes, the stock market is also trying to finish on a (slightly) higher note. Treasuries are flat. The dollar is weaker. Crude oil, gold, and silver are higher.

On the news front...

We’re barreling toward a government shutdown, barring a last-minute compromise between House Speaker Kevin McCarthy and hardline Republicans who are pushing for assurances on spending and social issues.

Many consider it to be mostly a “Washington DC Story.” But this informative piece explains how it could impact markets as well. The short version? Key economic data won’t be released, initial public offerings (IPOs) might get delayed, and home closings could be pushed out due to insurance-related problems.

Meanwhile, the bearish headlines and market articles are piling up as markets slump into quarter-end. Here’s one example from the Wall Street Journal, which leads off with the following:

“It seemed like nothing could stop the 2023 market rally. Then the third quarter arrived.”

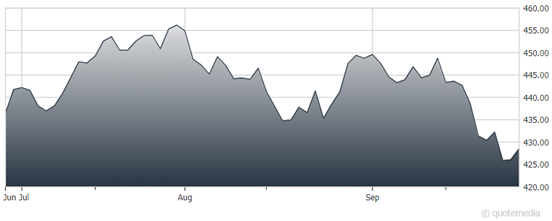

S&P 500 ETF Trust (SPY)

The piece goes on to say the S&P 500 is set to finish Q3 down 3.4% and is “hanging on” to a 12% rise for the year. The Nasdaq Composite has shed 4.3% and should end up with its worst quarterly performance since Q2 2022. The factors to blame? You guessed it. The same ones I wrote about earlier this week: Rising rates and a rising dollar.

That said, many of our experts have pointed to improving seasonals and negative sentiment as likely drivers of a Q4 rally. So be sure to keep your antennae up for that if you’re an investor who likes to bargain hunt!