Call it the “Revenge of the Old Schoolers”! The Dow Jones Industrial Average scored its best performance relative to the Nasdaq Composite since March 2021 yesterday. Today, most stocks are trying to tack on more points in the early going.

Meanwhile, crude oil is higher, while gold and silver are down a smidge. Treasuries are rallying at the long end of the yield curve, while the dollar is up slightly.

On the news front…

We saw the first significant “Big Tech” faceplant yesterday in the wake of disappointing earnings from Netflix (NFLX) and Tesla (TSLA). The Nasdaq Composite Index dropped 2.1%, with NFLX losing more than 8% and TSLA falling just under 10%.

But the Dow Jones Industrial Average was another story entirely. The stodgier, old-school index rose 160 points, or 0.5%, on the day. That was its ninth-straight advance, the longest positive streak since 2017. The healthcare products and pharmaceutical giant Johnson & Johnson (JNJ) surged more than 6% on stronger-than-expected Q2 profits. It’s now trading at its highest level since January.

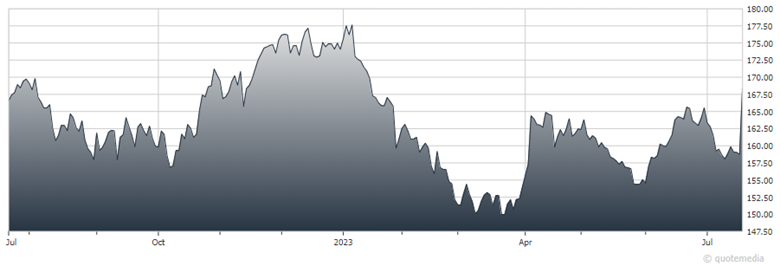

Johnson & Johnson (JNJ)

Finally, if you’ve spent any time at an airport recently, this news should come as no surprise. But the airline industry is booming again, with sales and profits soaring and passenger traffic on fire. The Transportation Security Administration is now screening almost 2.9 million people on peak summer days, an all-time high.

The U.S. Global Jets ETF (JETS), a $1.9 billion ETF that owns shares of major airlines and other travel-related stocks, is up 27% year-to-date. That handily beats the S&P 500.