The stock market initially ripped higher yesterday on tamer consumer inflation data, before easing back into the close. We’re getting a subdued rally this morning on tamer PRODUCER inflation data. We’ll see if it sticks.

Meanwhile, crude oil, gold, and silver are mixed while Treasuries are flattish. The dollar is weaker, with the benchmark Dollar Index slumping to its lowest since April 2022.

On the news front…

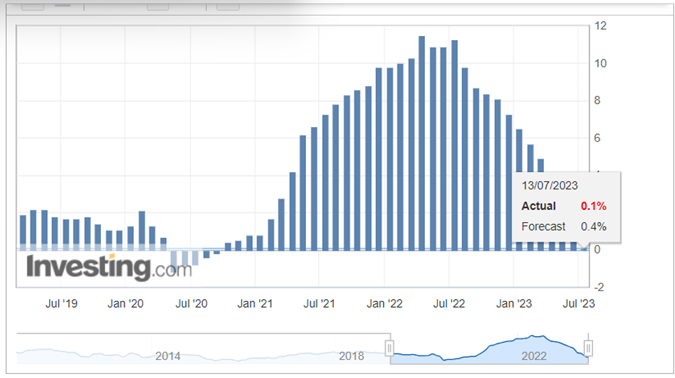

We got our second dose of encouraging inflation news today, with the Producer Price Index rising just 0.1% on the headline and the “core” (ex-food and energy) in June. On a year-over-year basis, wholesale inflation was a scant 0.1%, too – the lowest since August 2020.

As you can see in this chart from Investing.com, we’ve come a LONG way in the past few quarters. This kind of data all but guarantees the Federal Reserve will cease hiking rates after one more move later this month. In fact, the CME’s FedWatch Tool showed a 92% change of one last 25-point hike to a range of 5.25%-5.5% at the meeting that concludes July 26...and an 82% chance the funds rate stays at that level at the conclusion of the following meeting September 20.

In other news, Perrigo (PRGO) won Food and Drug Administration (FDA) approval to sell its birth control pill Opill over-the-counter. The medication has long been deemed safe and effective. But it was only available by prescription. PRGO shares rose in the early going on the news.

Finally, we’re kicking off the Q2 earnings season in earnest tomorrow. A slew of mega-banks will release numbers, including JPMorgan Chase & Co. (JPM), Wells Fargo & Co. (WFC), and Citigroup (C). Investors will closely scrutinize the sector’s results for signs this year’s banking crisis is behind us.