It’s easy to pinpoint the big mover in the early going here: Crude oil! Futures are spiking almost 7% for reasons I’ll explain in a minute.

Equities are mixed, as are gold and silver. Treasuries and the dollar are a bit lower.

On the news front...

Markets are reacting vigorously to Sunday’s “OPEC Surprise”. Several OPEC members agreed to slash production by 1 million barrels per day yesterday. That is on top of the 2 million BPD they cut production by back in October.

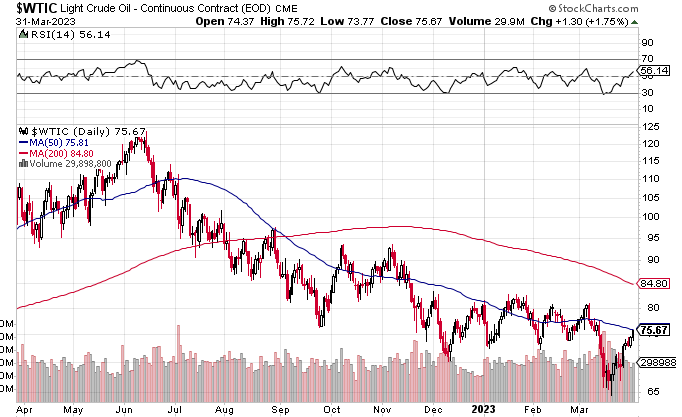

Saudi Arabia will account for the lion’s share of the cuts, with OPEC’s goal clearly to prop up sagging prices. Washington reacted with dismay as the last thing anyone in D.C. wants to see is higher domestic oil and gas prices. Crude futures surged as much as 8% today. But as you can see in this chart, it’s been a tough slog over the last year.

Tesla (TSLA) said it delivered just under 423,000 cars to customers in Q1 2023, up 4% from the previous quarter. The news followed CEO Elon Musk’s decision to slash the cost of several models by as much as 20%. Turns out when you lower the price of something, you sell more units. Who knew?

Meanwhile, fast food giant McDonald’s Corp. (MCD) is reportedly planning layoffs this week. No word yet on how many jobs are on the chopping block as part of MCD’s “Accelerating the Arches 2.0” efficiency program. The stock was recently up 6% YTD.