Environmental, Sustainable and Governance Investing (ESG) are also called Impact or Socially Responsible Investing (SRI), explains Nancy Zambell, editor of Wall Street's Best Investments.

ESG investments are “made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return.”

Impact investing is becoming increasingly interesting to investors. A recent report from the Morgan Stanley Institute of Sustainable Investing noted that 85% of individual investors and 95% of millennials say they are interested in sustainable options.

However, only about one-half of them really invest in companies whose mission is to positively impact society or our environment—and make money too!

And lest you think that socially responsible investing is a new ‘fad’, you would be wrong. The concept actually dates back to biblical times.

The concept has evolved to include companies that fight against climate change, advocate renewable resources, want to create a more equitable world, eschew ‘sin’ stocks (gambling, alcohol, tobacco, guns, even marijuana), and those that promote ethical work practices, a diverse Board of Directors, and gender equality

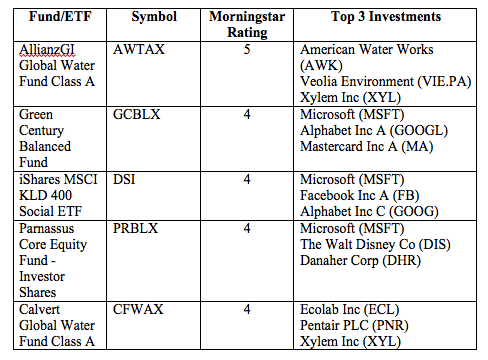

Fortunately, Moringstar.com does a great job of rating mutual funds and ETFs, although ratings aren’t yet available on all funds and ETFs, mostly due to lack of history.

Morningstar uses a scale of one to five stars, based on performance, risks, and costs. Ratings for three-, five- and 10-year periods are combined into an overall rating.

In my research, I looked at about 25 of the most popular SRI funds, searching for the highest-rated. Here are five for your consideration.

You have many choices in ESG investing; I prefer to focus on ETFs and funds, as they make it easy to diversify your investments within any category, and they are a great way to begin your socially responsible investing. There are many more ESG investments to choose from, but the ones above are a good start.