Last Thursday was not a happy day in the bond market. Neither was it a happy day in the stock market. Why? Trump Tariff Turmoil (TTT) hasn't been significantly reduced by the president’s 90-day postponement of reciprocal tariffs, writes Ed Yardeni, editor of Yardeni QuickTakes.

The 10-year Treasury bond yield rose to 4.45% late Thursday, up from a recent low of 4.01% on April 4, two days after Liberation Day. Last Wednesday, Trump partially postponed Liberation Day because the bond market was “tricky.” It remains tricky.

Yields rose even though the March CPI inflation rate was lower than expected. The Treasury reported that the federal budget deficit totaled $2.1 trillion over the past 12 months. It was $2.6 trillion over the past six months at an annual rate.

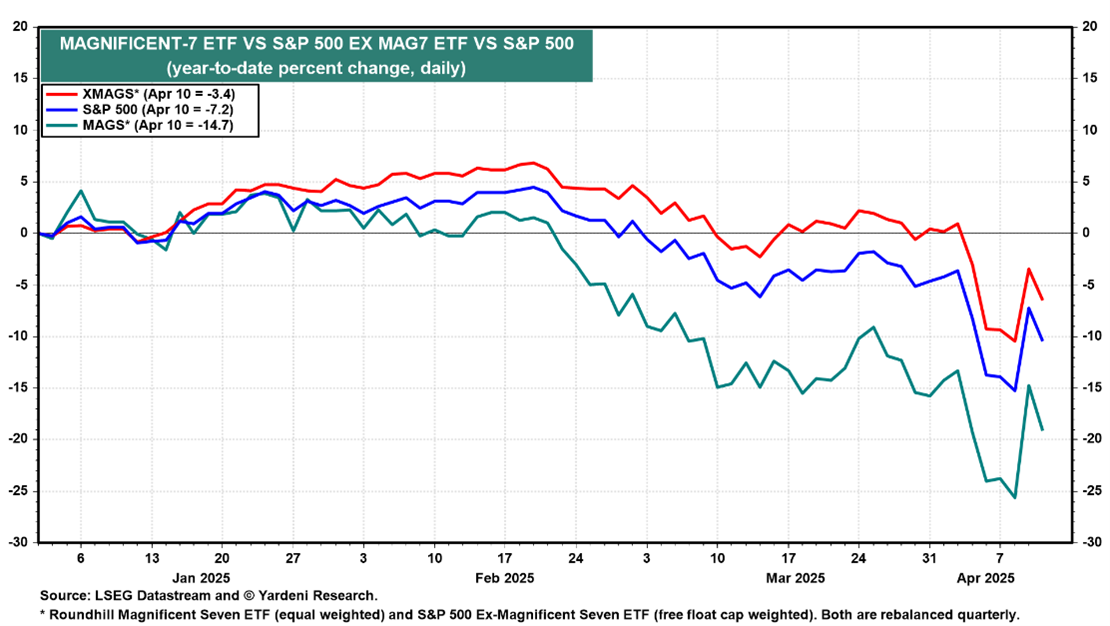

As for stocks? After one of the best one-day performances on record Wednesday, the major US stock market price indices fell more than 4% despite upbeat economic news. TTT hasn't been significantly reduced.

The now-145% tariff on China will make various imports too expensive and disrupt business operations. Public and private companies will have to find new suppliers, reduce margins, and raise prices. The 25% tariff on auto imports will drive up their prices significantly along with the cost of auto insurance.