The March Producer Price Index unexpectedly fell 0.4% on the headline, versus the estimate for a rise of 0.2% (after a one-tenth gain in February, which was revised up by one tenth). But core goods prices, in light of tariffs, are now the key figure to watch, explains Peter Boockvar, editor of The Boock Report.

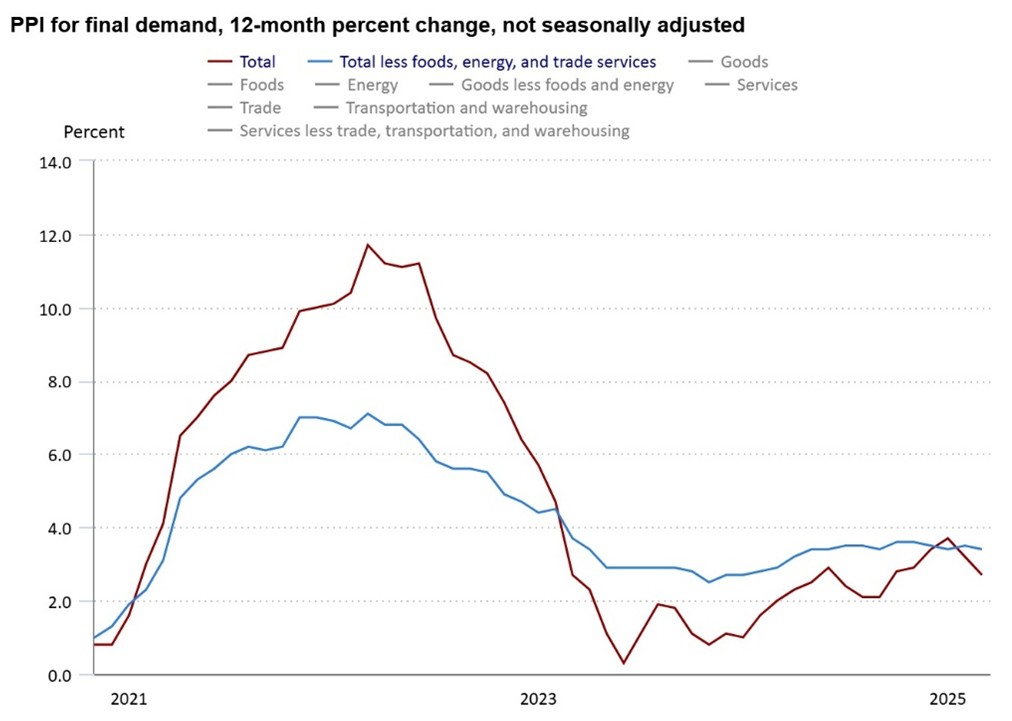

Versus last year, headline PPI was up 2.7%. The core rate was up by 3.3%. And ex-food, energy, and trade, it was up by 3.5%.

A 4% drop in energy prices weighed on the headline, with prices down 6.7% year-over-year. Food prices fell too, by 2.1% month-over-month, helped by a 21% drop in egg prices after the spikes seen in the two prior months. Food prices are still up 3.7% YOY.

Source: Bureau of Labor Statistics

As for those core goods prices, they rose 0.3% MOM for a second month and 2.4% YOY. I do think there were some signs of pre-tariff activity that showed up in terms of shipments.

“Truck transportation of freight” prices jumped 0.7% MOM and are now up 3.6% YOY. “Air transportation of freight” prices rose 0.5%. I did hear the story of Apple Inc. (AAPL) flying iPhones out of China to avoid tariffs, but haven’t been able to confirm that. The prices of “rail transportation of freight, mail” were unchanged from February, but up 3.1% YOY.

Bottom line, we’ll take the inflation relief...but who knows what the tariffs will look like in coming months? And I’ll say again that the core goods figure within this data will be most important to watch as to what prices are being absorbed at the producer level. Core goods prices within the Consumer Price Index will then tell us to what extent they are getting passed through to us.