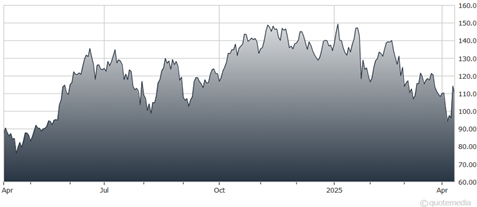

There have been plenty of market meltdowns over the years. Few have matched what happened since last Wednesday evening – so-called “Liberation Day.” But then, President Trump issued a 90-day pause on most tariffs, causing a sigh of relief for the market. I like Aegon Ltd. (AEG) here, advises Chris Preston, chief analyst at Cabot Value Investor.

Who knows how the tariff situation will evolve in the coming hours, let alone the coming days? Perhaps Tuesday was the bottom. Maybe it’s still days, weeks, or even months away.

But AEG shares trade at 6.8x forward earnings estimates, 0.52x sales, and have an enterprise value/revenue ratio of just 0.5. That makes it cheap on all fronts. AEG is far from sexy, but it has a history of churning out steady returns.

Aegon Ltd. (AEG)

If you’re not familiar with AEG, it’s a mid-cap ($8.7 billion) Dutch life insurance and financial services company that’s nearly 180 years old. Its largest and perhaps most recognizable business is Transamerica, a leading provider of life insurance, retirement, and investment solutions in the US.

With more than 10 million customers, Transamerica targets America’s “middle market,” and its wholly owned insurance agency World Financial Group – which boasts 86,000 independent insurance agents – helps facilitate the insurance part of Transamerica’s business plan. Aegon also does business in the UK and around the world.

Aegon’s sales peaked in 2019, when the company raked in a record $68.7 billion as the pre-Covid market hit a crescendo. Covid hurt ($42 billion in 2020), and the 2022 bear market hurt even worse (Aegon actually lost $4 billion that year). But the company has since rebounded, with 2023 revenues coming in at $32 billion.

While revenues mostly held steady in 2024, the company became profitable again, reporting $797 million in net profits in the second half of 2024 alone, with free cash flow of $414 million. This year, the company expects its operating capital generation (the amount of capital a company generates from its ongoing business operations, excluding one-time events) to improve 46% and its cost of equity to shrink.

Meanwhile, Aegon is returning its extra cash to shareholders in droves, announcing a $1.25 billion share repurchase program over the next three years, and upping its dividend payout by 19% last year. That results in a very generous current dividend yield of 6.2%.

Recommended Action: Buy AEG.