Strange as it may seem, the best place to hide from a market crash is amid high-flying microchip stocks. Nvidia Corp. (NVDA) was recently down 32% from its 52-week and all-time high of $149. But looking backward, even that high looks more than justified as the company’s earnings growth continues to soar, writes George Gilder, chief analyst at Gilder’s Technology Report.

We happily concede that before the great Trump Tariff Trapeze Act, froth suffused both the broad market and the Nasdaq. Puffing up those indexes were chip stocks, sure. But their prices were for the most part well-grounded in fundamentals, above all earnings growth. That makes them solidly grounded value stocks, even super-bargains, today.

What is true for NVDA is true for the entire sector, if less dramatically. High performance computing and AI have transformed the role of computers in our lives and culture. That is just what we predicted back in 2019, when we first re-launched the Gilder’s Technology Report and Nvidia bought Israeli bandwidth virtuoso Mellanox. At the time, Santa Clara, California-based Nvidia’s CEO Jensen Huang said, “Mellanox held a much larger footprint in the data center than Nvidia did.”

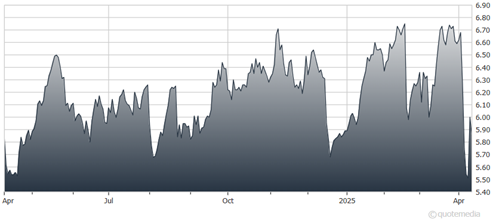

Nvidia Corp. (NVDA)

In this luminous new world, shedding physical constraints utterly relies on physical hardware. Wrought from, and on, excruciatingly designed and detailed physical machines and materials, the semiconductor will enable exponentially more wealth in the next few decades than during the 50 years since the creation of the microprocessor.

Demand for these devices will surge exponentially as an industry trammeled by mazes of “chips” and wires escapes from its plastic and fiber 3D towers and 2.5D stacks of “chiplets” and “interposers.” All fraught with growing constraints of heat and power, the data-centric, wire-raveled, mainframe model will succumb to new engineering breakthroughs. Coming soon is a return to wafer-scale planarity as momentous as Bob Noyce’s first planar integrated circuit.

As for NVDA, for at least the next two to three years, no company on earth will surpass it in importance to the high-performance computing that is recreating the world. That is all the more reason to note that for the first time in three years, NVDA has a humanly comprehensible forward PE (price earnings ratio) of just 21.

Its price/earnings-to-growth (PEG) ratio, the price the market pays for growth, is only 0.7, compared to a fair value of 1. On our own calculation, the stock is undervalued by half. And it’s not the only semiconductor stock going that cheaply.

Recommended Action: Buy NVDA.