I probably don’t need to tell you that the stock market’s been getting hammered. Nor can I say I’m surprised. This is precisely the type of big drop I’ve been warning about for many months now. Consider Inverse ETFs like the ProShares UltraShort Dow30 ETF (DXD) for protection, writes Nilus Mattive, editor of Safe Money Report.

In my opinion, there’s still more potential downside ahead. Whether you agree with President Trump’s end goals or not, we are clearly entering uncharted economic waters right now.

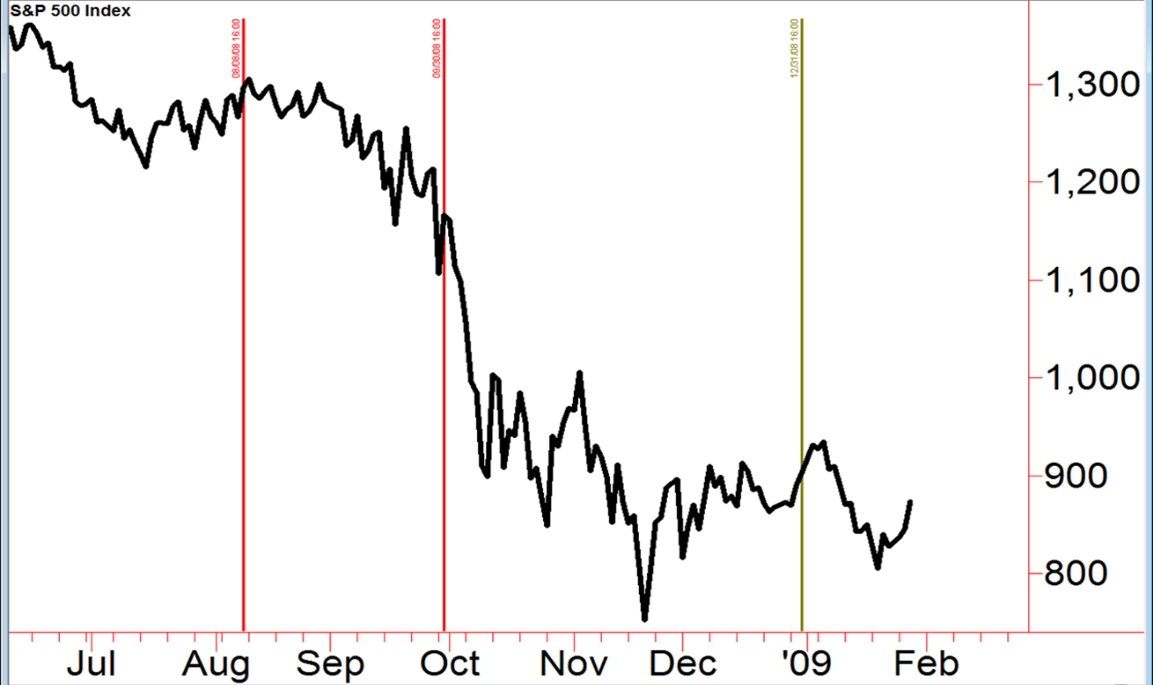

What’s happening right now reminds me a lot of the action in the summer of 2008. I was writing a newsletter focused on dividend stocks at Weiss Ratings. On Aug. 8, 2008, I told my readers to consider hedging their portfolios with a simple inverse ETF that would rise in value if the Dow index dropped. (First red line in my chart.)

Sure enough, the market DID start cracking as you can see from this chart of the broad market. So, on Sept 30, I recommended they double their stake in the same inverse Dow ETF. (Second red line in my chart.)

Again, that proved to be a good call…because shortly afterward, the market REALLY caved…dropping as much as 36% in just the next two months. What happened to the value of that inverse ETF? It took off!

DXD is designed to surge twice as much as the Dow falls — so it actually rocketed in value more than 70%! Plus, inverse ETFs can be bought and sold easily. They can be held in any type of brokerage account. They require no special clearances. And they do not require any type of external leverage like margin.

Just remember one thing about LEVERAGED inverse ETFs: You should only use them for very short time periods because of something known as tracking error. That can be a serious drawback depending on your time horizon.

If you’re looking for a simple way to hedge against any further weakness, now’s a good time to get reacquainted with these very simple — but powerful — tools.