Let’s start with a clear-eyed look at how the Trump Administration’s trade war is likely to affect the utility sector. Worth highlighting: Though far reaching, these tariffs are only one factor that will affect investment returns going forward, writes Roger Conrad, editor of Conrad’s Utility Investor.

Up until last week’s trading action, for example, a great rotation out of high-priced Big Tech stocks and into relatively inexpensive, high-quality companies in other sectors was gathering steam. The supply/demand equation had begun shifting in favor of commodity producers and other hard assets. And slowly but surely, the Federal Reserve was pivoting to lower interest rates as inflation allowed.

These are still critical factors to watch in coming weeks. In fact, it’s fair to say the tariffs’ impact is best measured by how they affect them, rather than the other way round.

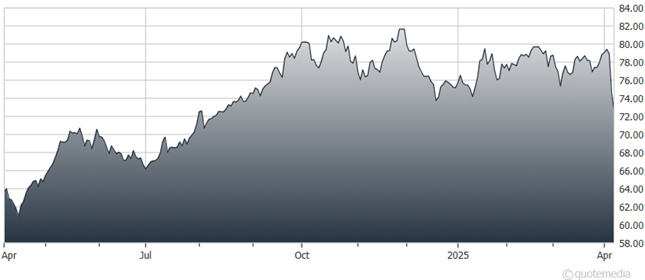

Utilities Select Sector SPDR Fund (XLU)

Second, we don’t know whether the major impact of Trump’s tariffs will be accelerating inflation, a recession, or more likely, some degree of “stagflation.” What is sure is American business and consumers will pay the US government a tax for almost all imported products and services. That includes parts and ingredients used to manufacture other products and services.

Odds are if a company has been able to maintain its margins the past few years against inflation, it has pricing power. And it should be able to pass the cost of tariffs along to the end user, rather than eat them and reduce earnings and investment.

That bodes well for electric power producers, which continue to report robust pricing for long-term sales contracts as industrial demand surges. Nearly a decade of slow building and rising natural gas demand for electricity and LNG exports should do the same for best-in-class energy midstream companies. And regulated power, gas, and water utilities enjoy support of cost of service rates, allowing them to pass on prudently incurred costs.

As for interest rates, the Federal Reserve isn’t coming to the stock market’s rescue yet. But guidance issued in December remains intact, for two quarter-point cuts in the fed funds rate by the end of 2025. And the more stocks drop and the economy cools, the more likely rates will be cut faster.

The outlook for sub-investment grade or “junk” bonds is increasingly cloudy. But the investment grade companies that dominate the Utility Report Card coverage universe are likely to see some long-awaited relief on borrowing costs.