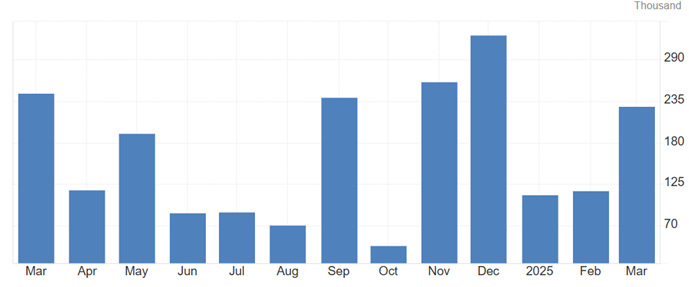

Friday’s employment report showed the economy added 228,000 jobs in March — beating even the highest estimate on Wall Street. While the unemployment rate crept up from 4.1% to 4.2%, last month’s jobs tally was revised significantly lower. Despite this, investors remain worried about the recent trade-war escalation, highlights Bret Kenwell, US investment analyst at eToro.

Investors are hurting in the current market environment, but they remain hopeful that stocks will find some sort of bottom in the coming days. That’s as the Nasdaq is flirting with bear market territory and the S&P 500 is down more than 12% from its record highs in February. Friday’s spike in the VIX finally sent the index above 40, which may be necessary to see some sort of capitulation.

Change in Nonfarm Payrolls

Source: Trading Economics

There’s no question that the trade war is fueling the current selloff. But the big question is if and when it will start to impact the economy in a meaningful way. Last Thursday’s report again showed that we have yet to see a significant spike in jobless claims, and if the most recent payrolls report avoids a large revision lower like we saw for February, it bodes well for the US economy.

Despite this, investors are worried about how the recent trade-war escalation — and the potential escalations to come — will impact earnings, confidence, and consumers.